Financial performance

2019: FURTHER STRONG GROWTH IN REVENUE AND IN RECURRING EBIT BASED ON THE TARGE SCOPE

The Lagardère group recorded revenue of €7,211 million in 2019, up 5% on a like-for-like basis and 4.1% based on consolidated figures, propelled by good momentum at Lagardère Publishing and Lagardère Travel Retail.

Recurring EBIT was 5.6% higher than in 2018, meeting the recurring EBIT target for the target scope as confirmed on 7 November 2019 (“Restated for the impact of IFRS 16 on concession agreements at Lagardère Travel Retail, at constant exchange rates and excluding Lagardère Travel Retail’s acquisitions of Hojeij Branded Foods (HBF) and International Duty Free (IDF)”). Recurring EBIT for the target scope came in at €361 million versus €310 million in 2018, buoyed by good performances from Lagardère Travel Retail and Lagardère Publishing, and by the consolidation of HBF.

Profit for the period was €11 million, down from €199 million in 2018 owing to the adverse impact of discontinued operations. Restated for non-recurring/non-operating items, adjusted profit - Group share was €200 million, stable year on year.

Against the backdrop of continuing brisk investment, net debt stabilised at €1,461 million at end-2019.

The leverage ratio (net debt2/recurring EBITDA3) was 2.1 at end-2019, stable relative to 2018.

2020 Outlook

At the time of the publication of the full-year 2019 results on 27 February 2020, the impacts of the Covid-19 epidemic were mainly being felt at Lagardère Travel Retail, and specifically in the Asia-Pacific zone and international travel hubs. The effects of the epidemic have since extended to Lagardère Travel Retail’s other operations and, to a lesser extent, to the rest of the Group’s activities, given both the rapid spread of the virus and the government lockdowns and closures that have been ordered in many of the countries in which the Group has operations.

As stated in its initial response, the Group is continuing to implement significant measures to mitigate the financial impacts in the following four areas: adapting sales and prices where possible, reducing overheads, reviewing investments, and reducing working capital.

Against this backdrop, the Group has suspended the guidance announced on 27 February 2020.

Condensed consolidated income statement

| (€m) | 2018 * | 2019 |

|---|---|---|

| Revenue | 6 868 | 7 211 |

| Group recurring EBIT | 385 | 378 |

| Income from equity-accounted companies** | 3 | 6 |

| Non-recurring/non-operating items | 22 | (33) |

| Finance costs, net | (57) | (53) |

| Income tax benefit (expense) | (124) | (55) |

| Profit for the period | 199 | 11 |

| Profit (loss) – Group share | 177 | (15) |

| Adjusted profit – Group share*** | 200 | 200 |

* Restated for IFRS 16.

** Before impairment losses.

*** Excluding non-recurring/non-operating items.

The consolidated financial statements were prepared in accordance with IFRS.

1 Lagardère Publishing, Lagardère Travel Retail, Lagardère News (Paris Match, Le Journal du Dimanche, Europe 1, Virgin Radio, RFM and the Elle licence), the Entertainment businesses, the Group Corporate function, and the Lagardère Active Corporate function whose costs will be wound down by 2020.

2 Net debt corresponds to the sum of short-term investments and cash and cash equivalents, financial instruments designated as hedges of debt, non-current debt and current debt.

3 Recurring EBITDA is calculated as recurring operating profit of fully consolidated companies plus dividends received from equity-accounted companies, less amortisation and depreciation charged against intangible assets and property, plant and equipment.

2019 General Meeting (Paris, France).

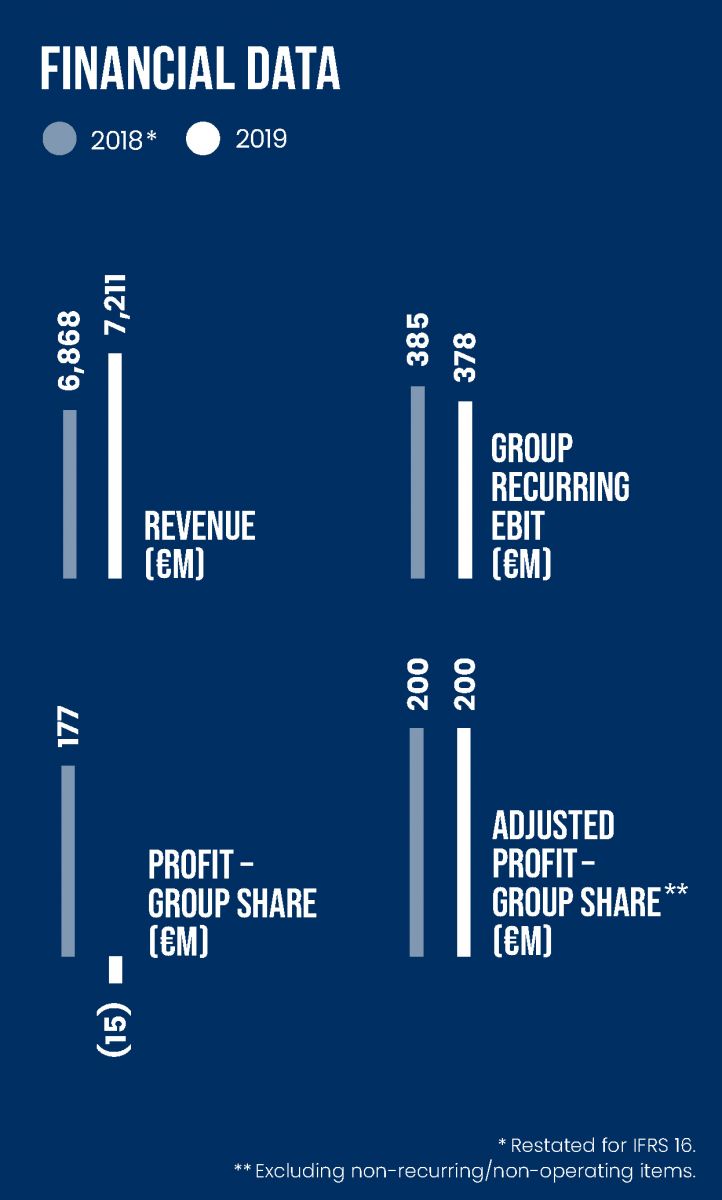

Financial data

- 2018*

- 2019

Revenue (€m)

- 2018 - 6 868

- 2019 - 7 211

Group recurring ebit (€m)

- 2018 - 385

- 2019 - 378

Profit – group share (€m)

- 2018 - 177

- 2019 - (15)

Adjusted profit – group share ** (€m)

- 2018 - 200

- 2019 - 200

* Restated for IFRS 16.

** Excluding non-recurring/non-operating items.

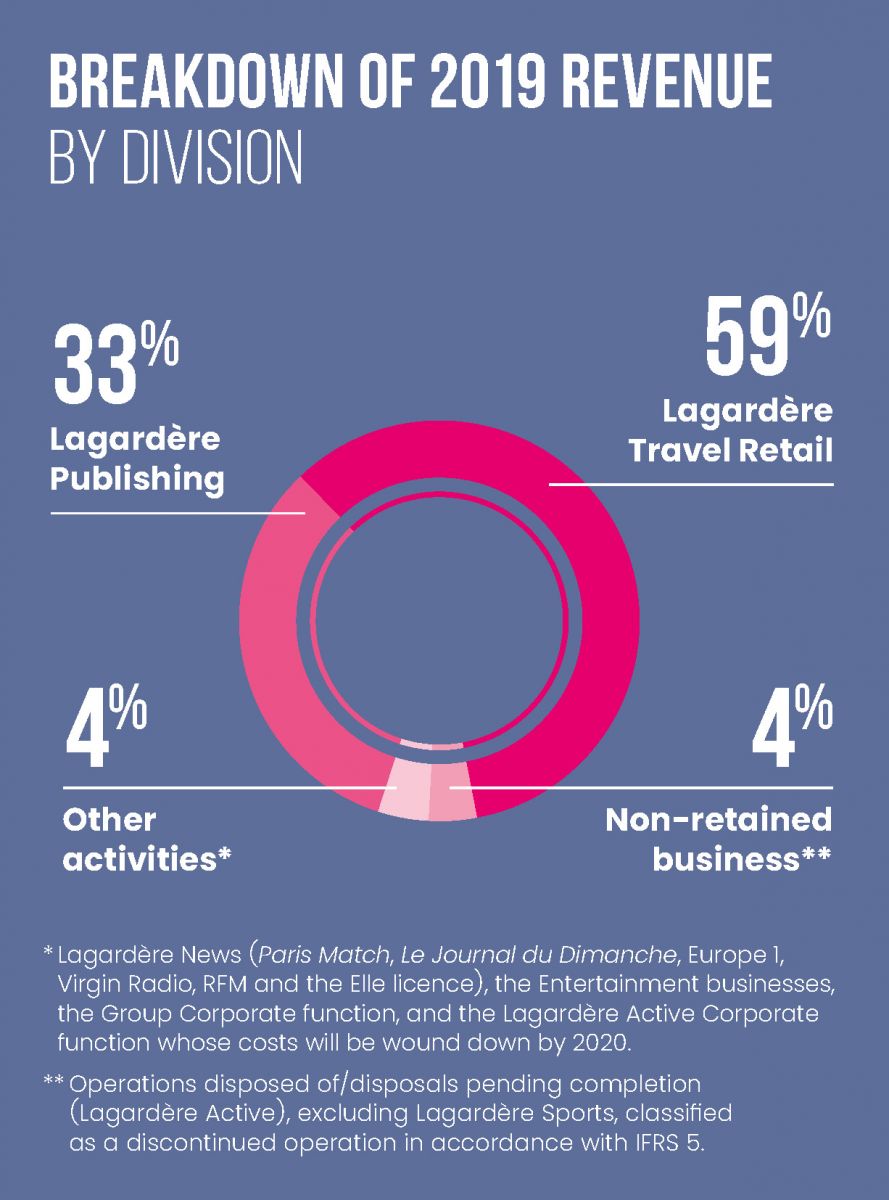

Breakdown of 2019 revenue by division

- 33% Lagardère Publishing

- 59% Lagardère Travel Retail

- 4% Other activities*

- 4% Non-retained business**

* Lagardère News (Paris Match, Le Journal du Dimanche, Europe 1, Virgin Radio, RFM and the Elle licence), the Entertainment businesses, the Group Corporate function, and the Lagardère Active Corporate function whose costs will be wound down by 2020.

**Operations disposed of/disposals pending completion (Lagardère Active), excluding Lagardère Sports, classified as a discontinued operation in accordance with IFRS 5.

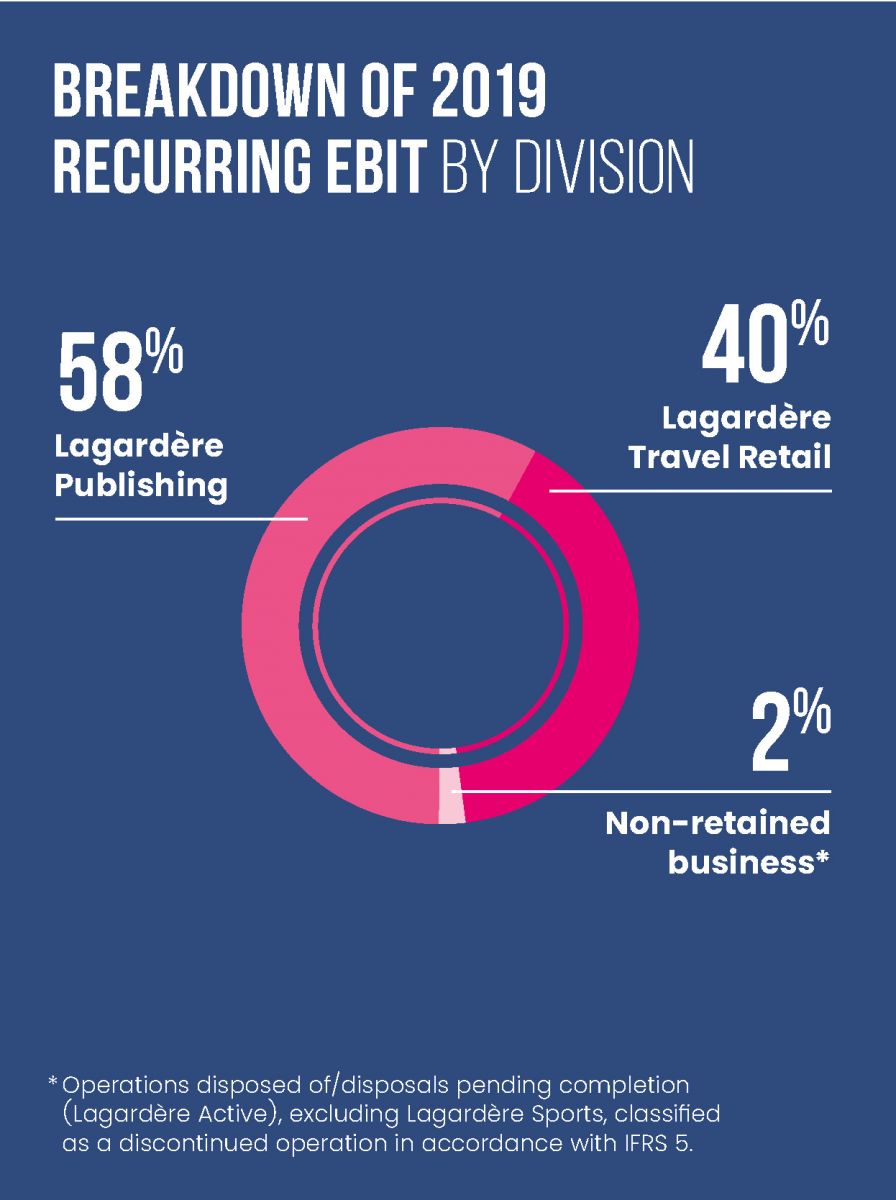

Breakdown of 2019 recurring ebit by division

- 58% Lagardère Publishing

- 40% Lagardère Travel Retail

- 2% Non-retained business*

* Operations disposed of/disposals pending completion (Lagardère Active), excluding Lagardère Sports, classified as a discontinued operation in accordance with IFRS 5.