Meeting the shareholders

2019 General Meeting (Paris, France).

| SHare ownership structure and voting rights at 31 december 2019 |

% Of capital | % Of voting rights |

|---|---|---|

| Lagardère Capital & Management | 7,26 % | 11,03 % |

| Treasury shares | 1,79 % | – |

| Employees and Group Savings Plan investment funds | 2,26 % | 2,66 % |

| Individual shareholders | 10,46 % | 12,21 % |

| French institutional investors | 11,82 % | 12,61 % |

| Non-French institutional investors | 66,41 % | 61,49 % |

| Total | 100,00 % | 100,00 % |

| KEY FIGURES | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|

| Earnings per share | 0,58 € | 1,36 € | 1,38 € | 1,49 € | -0,12 € |

| Adjusted* earnings per share | 1,87 € | 1,84 € | 1,68 € | 1,71 € | 1,55 € |

| Ordinary and extra dividends per share | 1,30 € | 1,30 € | 1,30 € | 1,30 € | 0 € ** |

| Share price at 31 December | 27,51 € | 26,39 € | 26,73 € | 22,02 € | 19,43 € |

| Yield *** | 4,72 % | 4,93 % | 4,86 % | 5,90 % | – |

| Market capitalisation (€m) at 31 December | 3 607 | 3 461 | 3 505 | 2 888 | 2 548 |

* Excluding non-recurring/non-operating items.

** In view of the solidarity and corporate responsibility required by the unprecedented context of the Covid-19 pandemic crisis, the Managing Partners, in agreement with the Supervisory Board, have decided to modify the proposed allocation of the Company's results for the year submitted to the General Meeting of 5 May 2020, and not to pay a dividend.

*** Theoretical yield for proposed ordinary dividend/share price at 31 December.

Information about lagardère shares

- Codes: ISIN (FR0000130213), Ticker (MMB), Bloomberg (MMB:FP), Reuters (LAGA.PA).

- Listing market: Euronext Paris (compartment A).

- Member of: SBF 120, MSCI Small Cap Index, STOXX® Europe 600 Media.

- At 31/12/2019, Lagardère was included in the following ESG indices: Vigeo Euronext Europe 120, Vigeo Euronext Eurozone 120, FTSE4Good Index series, MSCI Global Sustainability Index series, Ethibel Sustainability Index (ESI) Excellence Europe and STOXX® Global ESG Leaders Index. The Lagardère group is also included in SAM’s 2020 Sustainability Yearbook for the media sector.

- Shares eligible for the Deferred Settlement Service (SRD) and French “PEA” share savings plans.

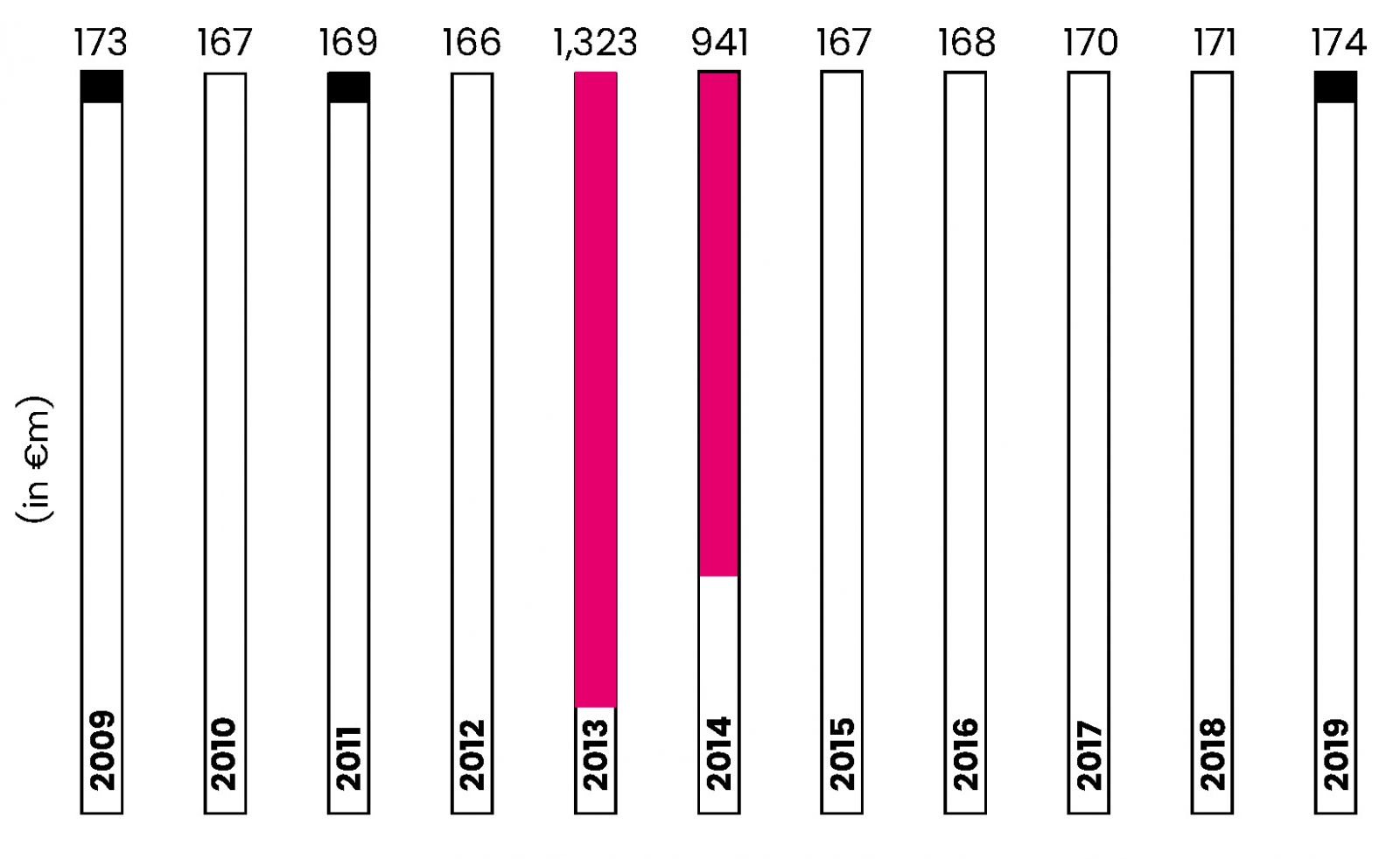

Paymenents to shareholders since 2009

Payments made to shareholders each year in respect of the previous financial year

(in €m)

- 2009 - 173

- 2010 - 167

- 2011 - 169

- 2012 - 166

- 2013 - 1 323

- 2014 - 941

- 2015 - 167

- 2016 - 168

- 2017 - 170

- 2018 - 171

- 2019 - 174

€3.8 bn paid out to shareholders

- Ordinary dividend

- Extra dividend*

- Share buyback

* In 2014, Lagardère paid an extra dividend of €6 per share for 2013 following the sale of its interest in Canal+ France. In 2013, Lagardère paid an extra dividend of €9 per share following the sale of its interest in EADS.

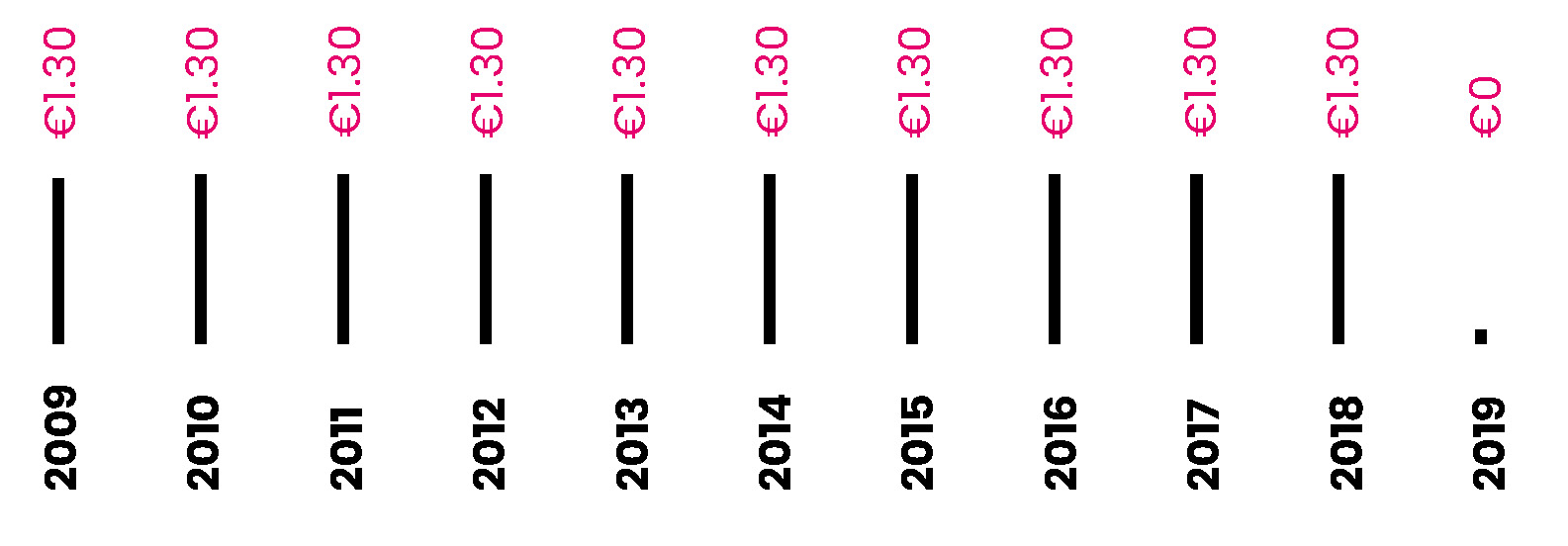

DIVIDEND

Proposed ordinary dividend per share since 2009

- 2009 - 1,30 €

- 2010 - 1,30 €

- 2011 - 1,30 €

- 2012 - 1,30 €

- 2013 - 1,30 €

- 2014 - 1,30 €

- 2015 - 1,30 €

- 2016 - 1,30 €

- 2017 - 1,30 €

- 2018 - 1,30 €

- 2019 - 0 €

In view of the solidarity and corporate responsibility required by the unprecedented context of the Covid-19 pandemic crisis, the Managing Partners, in agreement with the Supervisory Board, have decided to modify the proposed allocation of the Company's results for the year submitted to the General Meeting of 5 May 2020, and not to pay a dividend.

Shareholders' consultative committee

In 1997, the Lagardère group formed a Shareholders' Consultative Committee representing individual shareholders.

The Committee's objectives are to:

- improve financial communications between the Group and its shareholders;

- reflect on shareholders' expectations and their perception of the Group and its investor relations policy (financial results, strategy, the Annual General Meeting etc.).

The Committee consists of representatives of individual shareholders along with representatives of Lagardère.

The Committee considers primarily themes such as:

- financial communication via the Group's website;

- sustainable development;

- the annual report;

- the Group's business development and strategy.

Anyone interested in becoming a member and participating in the Committee's work should contact the Investor Relations Department via the Investor Relations section of the Lagardere.com website.

Shareholder relations

Information for shareholders

The Group provides its shareholders with comprehensive and easily accessible financial information on a regular basis and in various ways including the distribution of financial press releases by an AMF-approved provider, publications on its website, and live broadcasts of financial results presentations and the Annual General Meeting.

The Lagardere.com website includes two sections especially for investors and individual shareholders, including documents relating to the Annual General Meeting, answers to frequently asked questions and information about how to become a shareholder.

Specific sections are also provided on particular topics such as sustainable development, corporate governance, regulated information and debt.

Meetings with investors and financial analysts

In 2019, the Group organised face-to-face meetings or conference calls with investors (holding shares and bonds) and financial analysts and took part in roadshows and sector-specific conferences in Europe and North America. The Group also carried out specific communications relating to its strategy within the framework of Investor Days, intended to improve understanding of certain business activities by the financial community: the Group’s growth strategy in 2014, Lagardère Travel Retail in 2016 and Lagardère Publishing in 2017.

The Group maintains close and regular relations with financial analysts, particularly when reporting earnings or revenue (conference calls).

Information meetings for individual shareholders are also organised across the French regions.

Securities services and regitered shares

The shares that make up Lagardère SCA’s share capital are all registered shares, held either in administered form (via a financial intermediary) or in directly registered form (via BNP Paribas Securities Services).

Thanks to this form of shares, all shareholders:

- are systematically invited to Annual General Meetings and can vote more easily by post or online;

- benefit from double voting rights once they have held shares on a continuous basis for four years.

Practical information about how to transfer directly registered shares to BNP Paribas Securities Services can be found on the Lagardère website.

The main advantages of holding shares in directly registered form are:

- no custodian fees (details of other fees relating to ownership of directly registered shares are given on the Lagardère website);

- dividends paid directly on the date of payment decided by the Annual General Meeting;

- free handling of standard instructions relating to the ordinary running of the securities account: transfers, donations, adjustments etc.;

- taking care of communicating instructions from the shareholder to sell securities;

- guaranteed receipt of documents relating to the running of the account periodically or on request, as soon as possible and free of charge, with the possibility of opting for electronic communications.

Financial calendar1

- 30 April 2020

First-quarter 2020 revenue - 5 May 2020

General Meeting, fiscal year 2019 - 30 July 2020

First-half 2020 results

1 Dates may be susceptible to change.

BUSINESS MODEL

A sustainable value creation model

| inputs and resources (1) | ||

|---|---|---|

| Human capital | Financial capital | Environmental and societal capital |

|

|

|

| businesses | ||

|---|---|---|

| Lagardère is an international group with operations in more than 40 countries worldwide. It ranks among the world leaders in publishing (Lagardère Publishing) and travel retail (Lagardère Travel Retail). |

||

| Lagardère publishing | Lagardère travel retail | Other activities(4) |

|

|

|

| VALUE CREATION (1) | ||

|---|---|---|

| Employee value | Financial value |

Societal and economic value |

|

|

|

(1) Data at 31 December 2019.

(2) Leverage ratio: Net debt/recurring EBITDA.

(3) Oil, gas, electricity and district heating.

(4)Mainly comprising Lagardère News (Paris Match, Le Journal du Dimanche, Europe 1, Virgin Radio, RFM and the Elle brand licence) together with Lagardère Live Entertainment.