2.3 Supervisory Board

2.3.1 MEMBERS

A) OVERVIEW OF THE SUPERVISORY BOARD

SUPERVISORY BOARD MEMBERSHIP AND DIVERSITY IN 2020

63

Average age

37,5 %

Percentage of women on the Board(*)

10

Number of meetings

97 %

Attendance rate

100 %

Independence rate

SUPERVISORY BOARD

9 membres :

- Patrick Valroff (Chairman)

- Jamal Benomar

- Valérie Bernis

- Soumia Malinbaum

- Guillaume Pepy

- Gilles Petit

- Nicolas Sarkozy

- Susan M. Tolson

including 1 employee-representative member - Michel Defer

3 COMMITTEES

AUDIT

3 membres | 7 meetings| 92 % attendance rate

- Patrick Valroff (Chairman)

- Guillaume Pepy

- Susan M. Tolson

STRATEGY

4 members| 7 meetings| 100 % attendance rate

- Guillaume Pepy (Chairman)

- Gilles Petit

- Patrick Valroff

- Nicolas Sarkozy

APPOINTMENTS, REMUNERATION AND CSR

4 members| 7 meetings| 100 % attendance rate

- Gilles Petit (Chairman)

- Jamal Benomar

- Valérie Bernis

- Soumia Malinbaum

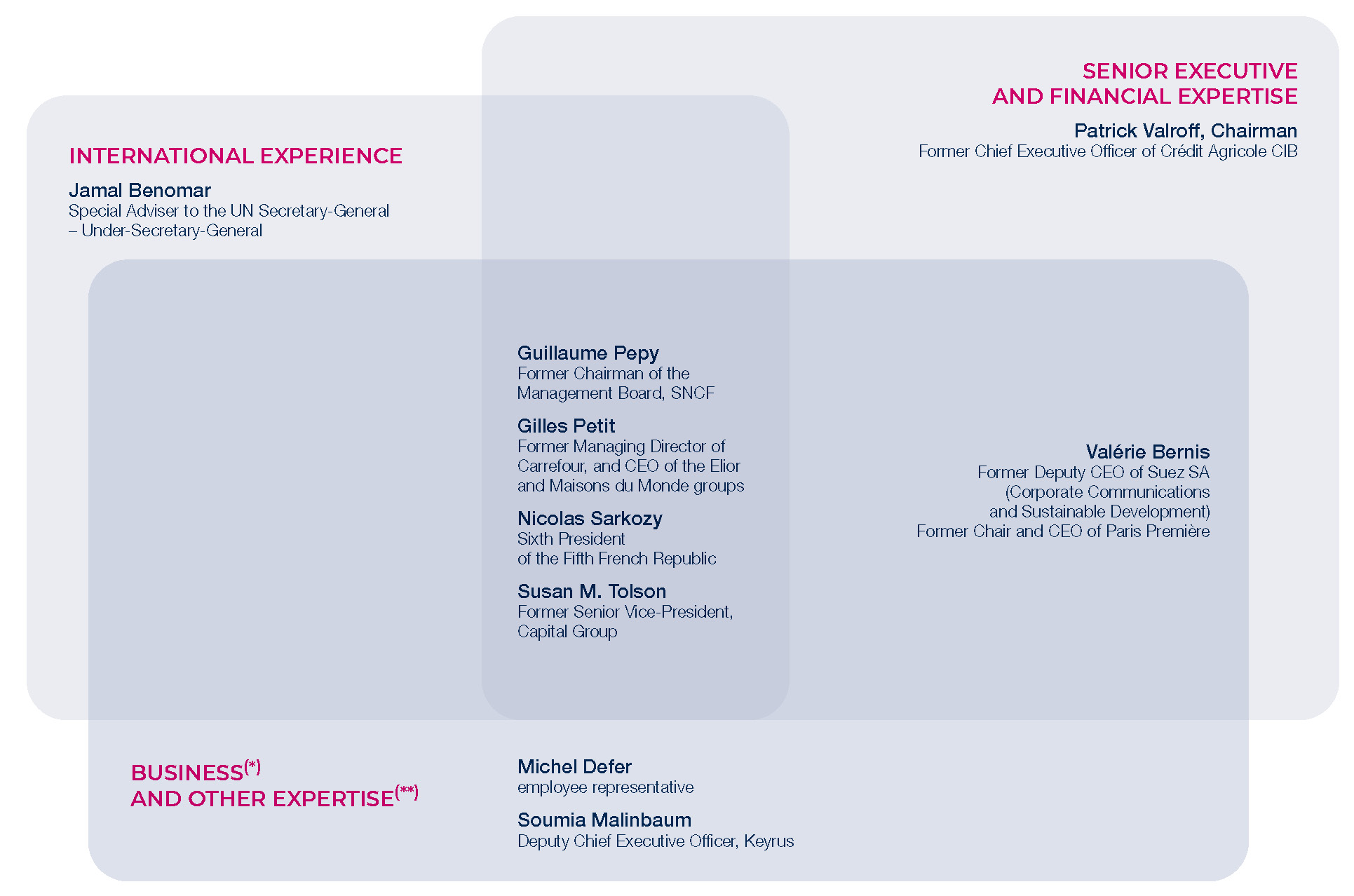

BOARD EXPERTISE

- International experience | 5 membres

- Senior executive and financial expertise | 6 membres

- Business and other expertise | 7 membres

(*) The percentage of women on the Board dipped below 40% further to the General Meeting of 5 May 2020, as a result of the vote not to re-appoint Martine Chêne.

Items appearing in the Annual Financial Report are cross‑referenced with the following symbol AFR

Pursuant to the Articles of Association, the Supervisory Board comprises a maximum of ten members plus either one or two members representing employees.

Around a quarter of Board members are replaced or re-appointed each year. Members are appointed for a maximum term of four years.

At 31 December 2020, the Board comprised nine members:

List of members of the Supervisory Board at 31 December 2020

| Personal information | Experience | Position on the Board | Participation in Board Committees | |||||||

| Age | Sex | Nationality | Number of shares | Number of directorships held in listed companies(1) | Independence(2) | First appointed | End of term of office | Board seniority | ||

| Patrick Valroff Chairman |

72 years | M | French | 600 | 0 | Yes | 27 April 2010 | 2022 OGM* |

11 years |

Audit Committee (Chairman) Strategy Committee |

| Jamal Benomar | 64 years | M | British Moroccan |

150 | 0 | Yes | 12 September 2018 |

2023 OGM* |

2 years | Appointments, Remuneration and CSR Committee |

| Valérie Bernis | 63 years | F | French | 150 | 2 | Yes | 31 August 2020(4) |

2021 OGM* |

1 years | Appointments, Remuneration and CSR Committee |

| Michel Defer Employee Representative |

60 years | M | French | 0 | 0 | N/A | 4 November 2020 |

4 November 2024 |

1 years | |

| Soumia Malinbaum | 59 years | F | French | 650 | 1 | Yes | 3 May 2013 | 2021 OGM* |

8 years | Appointments, Remuneration and CSR Committee |

| Guillaume Pepy | 63 years | M | French | 600 | 1 | Yes |

27 February 2020 (3) |

2024 OGM* | 1 years | Audit Committee meetings Strategy Committee (Chairman) |

| Gilles Petit | 65 years | M | French | 600 | 1 | Yes |

10 May 2019 | 2023 OGM* | 2 years | Strategy Committee Appointments, Remuneration and CSR Committee (Chairman) |

| Nicolas Sarkozy | 66 years | M | French | 1,301 | 3 | Yes |

27 February 2020 (3) |

2022 OGM* |

1 years | Strategy Committee |

| Susan M. Tolson | 59 years | F | American | 600 | 3 | Yes |

10 May 2011 | 2023 OGM* | 10 years |

Audit Committee |

| Laure Rivière Secretary |

||||||||||

(1) Outside the Lagardère group.

(2) Under the Afep-Medef corporate governance criteria applied by the Supervisory Board (see below).

(3) Co-optation effective 28 February 2020.

(4) Co-optation effective 1 September 2020.

* The Ordinary General Meeting to be held in the year indicated to approve the financial statements for the previous year.

B) LIST OF DIRECTORSHIPS AND OTHER POSITIONS HELD BY SUPERVISORY BOARD MEMBERS

| PATRICK VALROFF Chairman of the Supervisory Board Chairman of the Audit Committee Member of the Strategy Committee |

||

| Nationality: French 4 rue de Presbourg, 75116 Paris, France Date of birth: 3 January 1949 |

Patrick Valroff holds a degree in law and is a graduate of the Institut d’Études Politiques de Paris and École Nationale d’Administration. He began his career in the French civil service. In 1991, he joined the specialist consumer credit company Sofinco as Deputy Chief Executive Officer. In 2003, he was appointed Head of Specialised Financial Services at Crédit Agricole SA Group, which comprises Sofinco, Finaref, Crédit Agricole Leasing and Eurofactor, and subsequently served as Chairman and Chief Executive Officer of Sofinco. From May 2008 to December 2010, Patrick Valroff was Chief Executive Officer of Crédit Agricole Corporate and Investment Bank. Patrick Valroff is an honorary magistrate at the French National Audit Office (Cour des Comptes). |

|

| Directorships and other positions heldnin other companies In France: ► Director of not-for-profit association La Protection sociale de Vaugirard ► Member of the Financial Committee of the International Chamber of Commerce |

Directorships and other positions expired during the last five years ► Senior Advisor to Omnes Capital ► Director, Néovacs(1) |

|

(1) Listed company.

| JAMAL BENOMAR Member of the Supervisory Board Member of the Appointments, Remuneration and CSR Committee |

||

| Nationality: British and Moroccan 9 Rutland Road Scarsdale NY 10583 United States Date of birth: 11 April 1957 |

Jamal Benomar has 35 years of experience in roles with international responsibility, including as Special Advisor to the UN Secretary-General and as Under-Secretary-General. After earning degrees in sociology, economics and politics from the universities of Rabat, Paris and London, Jamal Benomar worked as a lecturer and research associate. At the UN, his work focused on diplomatic actions and governance issues. |

|

| Directorships and other positions held in other companies Outside France: ► Chairman of the Board of Directors of Centre international pour les initiatives de dialogue (ICDI) |

Directorships and other positions expired during the last five years None |

|

| VALÉRIE BERNIS Member of the Supervisory Board Member of the Appointments, Remuneration and CSR Committee |

||

| Nationality: French 86, avenue de Breteuil 75015 Paris, France Date of birth: 9 December 1958 |

Valérie Bernis is a graduate of the Institut Supérieur de Gestion and the Université de sciences économiques in Limoges. Having spent two years as Press and Communications Officer for the French Prime Minister’s Officer, in 1996 she joined Compagnie de Suez as Executive Vice-President – Communications, and then in 1999 was appointed Deputy CEO in charge of Corporate Communications and Sustainable Development. During that time, she also served for five years as Chair and CEO of Paris Première, a French TV channel. | |

| Directorships and other positions held in other companies In France : ► Member of the Board of Directors, Chair of the CSR Committee and member of the Remuneration Committee, Atos (1) ► Member of the Board of Directors, Chair of the Remuneration Committee and member of the Strategy Committee and the Commitments Committee, France Télévisions ► General Secretary of the Board of Directors, AROP (Opéra de Paris) ► Member of the Board of the French Alzheimer’s Research Foundation Outside France: |

Directorships and other positions expired during the last five years ► Member of the Supervisory Board of Euro Disney SCA(1) ► Member of the Board of Directors, Suez SA (1) |

|

(1) Listed company.

| MICHEL DEFER Member of the Supervisory Board Employee representative |

||

| Nationality: French 34, Grande Rue, 28700 Le Gue de Longroi, France Date of birth: 26 July 1960 |

Michel Defer, has been an employee of the Lagardère Publishing division for almost 38 years and is currently an electromechanical service technician at the Hachette Livre Services and Operations division distribution centre. | |

| Directorships and other positions held in other companies None |

Directorships and other positions expired during the last five years None |

|

| SOUMIA MALINBAUM Member of the Supervisory Board Member of the Appointments, Remuneration and CSR Committee |

||

| Nationality: French 17, rue des Acacias 75017 Paris, France Date of birth: 8 April 1962 |

Soumia Malinbaum has spent most of her career working in the digital and technologies sector, both as a founder and managing director of small and medium-sized companies. She is currently Deputy Chief Executive Officer of Keyrus, a management consulting firm which was merged with Specimen, the IT company she created and managed for 15 years. Before being appointed Business Development Manager of the group, she was Director of Human Resources. She is extremely committed to promoting and managing diversity in the corporate environment and is President of the European Association of Diversity Managers and founder of the French equivalent (AFMD). |

|

| Directorships and other positions held in other companies In France: ► Director of Nexity(1) and member of the Remuneration and Appointments Committee |

Directorships and other positions expired during the last five years ► Member of the Board of Directors, Université Paris Dauphine ► Director and Chair of the Audit Committee, FMM (France Médias Monde) ► Member of the Educational Board, HEC Paris ► Member of the Board of Directors, Institut du monde arabe (IMA) |

|

| GUILLAUME PEPY Member of the Supervisory Board Chairman of the Strategy Committee Member of the Audit Committee |

||

| Nationality: French 2, rue des Falaises Beaurivage 64200 Biarritz Date of birth: 26 May 1958 |

A graduate of Institut d’études politiques de Paris and École nationale d’administration, Guillaume Pepy began his career as an auditor before becoming a legal assistant at the Conseil d’État, France’s highest administrative court. Having pursued a career at ministerial office level (Technical Advisor to the Chief of Staff of the Budget department, Chief of Staff to the Minister for Civil Service and Administrative Reform, then Chief of Staff to the Minister for Labour, Employment and Vocational Training), he became Deputy Chief Executive Officer in charge of business development at the Sofres group in 1996. The following year, he took the helm at SNCF’s Mainline Services unit, later becoming head of all passenger business. He created Voyages-sncf.com and served as its chairman from 1998 to 2006, before being appointed Group Chief Operating Officer by Louis Gallois in 2003. On 27 February 2008, he was appointed by Nicolas Sarkozy as Chairman of SNCF for a five-year term, and was re-appointed by François Hollande in 2013. In his second term, Guillaume Pepy’s primary mission was to continue leading France’s major rail reform and pave the way for the creation of the new SNCF rail group on 1 January 2020. Guillaume Pepy has also been President of the Initiative France business support network since 30 June 2020 and Vice-President of the National Choreographic Centre in Biarritz since 11 September 2020. He is a Senior Advisor to Sales Force and to the Canadian Pension Plan Investment Board. | |

| Directorships and other positions held in other companies In France : ► Director, Patrimoine Orient-Express fund ► Director, Memorial pour la mémoire de la Shoah ► President, Initiative France ► Vice-President, National Choreographic Centre, Biarritz► Senior Advisor to BCG Paris Outside France: ► Senior Advisor to Sales Force (1) ► Senior Advisor for Europe to the Canadian Pension Plan Investment Board |

Directorships and other positions expired during the last five years ► Director, Chairman of the Appointment, Compensation and Governance Committee, member of the Strategy Committee, and Chairman of the Audit and Financial Statements Committee, Suez (1) ► Chairman of the Management Board, SNCF ► Chairman and Chief Executive Officer, SNCF Mobilités ► Member of the Supervisory Board, Systra ► Director, Comuto SA (BlaBlaCar) ► Member of the Supervisory Board, Keolis ► Member of the Board of Directors, Nuovo Traporto Viaggiatori ► Directorships and other positions held in various SNCF group companies |

|

(1) Listed company.

| GILLES PETIT Member of the Supervisory Board Member of the Strategy Committee Chairman of the Appointments, Remuneration and CSR Committee |

||

| Nationality: French 67, rue de Versailles 92410 Ville-d’Avray, France Date of birth: 22 March 1956 |

Gilles Petit is a well-known figure in the French retail landscape. Having begun his career in 1980 with Arthur Andersen, he joined the Promodès group in 1989, where at the time of the merger with Carrefour in 1999, he held the position of Chief Executive Officer of the hypermarkets division for Promodès in France. He was successively appointed Managing Director of Carrefour Belgium in 2000, Carrefour Spain in 2005, and Carrefour France in 2008, until he joined Elior as Chief Executive Officer and Chairman of the Executive Committee in 2010, taking charge of its stock market listing on Euronext Paris in 2014. He was appointed Chief Executive Officer of Maisons du Monde in 2015, and also successfully led its initial public offering. Gilles Petit is a graduate of the École supérieure de commerce de Reims, in France. | |

| Directorships and other positions held in other companies In France : ► Chairman, Gilles Petit Conseil Outside France: ► Director, B&M European Value Retail (UK (1) |

Directorships and other positions expired during the last five years ► Director, Maisons du Monde SA (1) ► Senior Advisor to the Chief Executive Officer of Maisons du Monde SA ► Chief Executive Officer, Maisons du Monde SA |

|

(1) Listed company.

| NICOLAS SARKOZY Member of the Supervisory Board Member of the Strategy Committee |

||

| Nationality: French 77, rue de Miromesnil 75008, Paris, France Date of birth: 28 January 1955 |

Nicolas Sarkozy was the 6th President of France’s Fifth Republic (2007-2012). Mayor of Neuilly-sur-Seine (1983-2002), National Assembly Representative for Hauts-de-Seine(1988-2002), President of the General Council for Hauts-de-Seine (2004-2007), Minister for the Budget (1993-1995), Minister for Communications (1994-1995), Government spokesman (1993-1995), Minister of the Interior, Internal Security and Local Freedoms (2002-2004), Minister of State, Minister for the Economy, Finance and Industry (2004), Minister of State, Minister of the Interior and Town and Country Planning (2005-2007). He was also the elected leader of French political parties UMP (2004-2007) and Les Républicains (2014-2016). A trained lawyer, Nicolas Sarkozy is married and has four children. He is the author of several books, including Libre, Témoignage, La France pour la vie, Tout pour la France, Passions and Le Temps des Tempêtes. |

|

| Directorships and other positions held in other companies In France : ► Director and Chairman of the International Strategy Committee, Accor (1) ►Director and member of the Strategy Committee, Lucien Barrière group ► Member of the Supervisory Board, Lov Group Invest ► Member of the Natixis International Advisory Network (1) Outside France: ► Member of the Advisory Board, Axian (Madagascar) ► Member of the Advisory Board, Chargeurs(1) (Switzerland) ► Member of the Advisory Board, SPAO Reso Garantia (Russia) |

Directorships and other positions expired during the last five years |

|

(1) Listed company.

| SUSAN M. TOLSON Member of the Supervisory Board Member of the Audit Committee |

||

| Nationality: American 2344 Massachusetts Ave NW Washington DC 20008 United States Date of birth: 7 March 1962 |

Susan M. Tolson graduated from Smith College in 1984 with a B.A. cum laude before obtaining an MBA from Harvard in 1988. She joined Prudential Bache Securities as a corporate finance analyst in 1984 and subsequently took on the position of Investment Officer in Private Placements at Aetna Investment Management in 1988. In 1990, she joined The Capital Group Companies – a major private US investment fund formed in 1931 – where between April 1990 and June 2010 she successively served as a financial analyst, senior account manager and then Senior Vice-President, a position she left to join her husband in Paris. Over the last 20 years, Susan M. Tolson has issued recommendations and made decisions relating to investments in numerous business sectors, including the media and entertainment industries. |

|

| Directorships and other positions held in other companies In France: ► Director, WorldLine E-Payment Services(1) and Member of the Audit, Governance and Remuneration Committees(1) Outside France: ► Director, Outfront Media(1), Chair of the Governance and Appointments Committee and member of the Audit Committee ►Director, Take-Two Interactive(1), Chairman of the Audit Committee ► Member of the Los Angeles World Affairs Council, the Paley Center For Media and the Los Angeles Society of Financial Analysts |

Directorships and other positions expired during the last five years ► Director, America Media, Inc. ► Member of the Board of Trustees, American University of Paris ► Honorary Chair, American Women’s Group in Paris ► Director, Fulbright Commission ► Honorary Chair, American Friends of The Musée d’Orsay ► Director, the American Cinémathèque ► Director, Terra Alpha LLC |

|

C) CHANGES IN COMPOSITION IN 2020

Changes in the composition of the Supervisory Board and the Supervisory Board Committees in 2020

At 31 December 2020

| Departures | Appointments | Re-appointments | |

| Supervisory Board | François David (28 February 2020) Xavier de Sarrau (28 February 2020) Nathalie Andrieux (5 May 2020) Martine Chêne (5 May 2020) Hélène Molinari (5 May 2020) Aline Sylla-Walbaum (17 August 2020) Yves Guillemot (27 August 2020) |

Guillaume Pepy (co-opted on 27 February 2020 with effect from 28 February 2020) Nicolas Sarkozy (co-opted on 27 February 2020 with effect from 28 February 2020) Valérie Bernis (co-opted on 31 August 2020 with effect from 1 September 2020) Michel Defer (appointed on 4 November 2020 by the Group Employees’ Committee) |

Guillaume Pepy (5 May 2020) |

| Audit Committee | Nathalie Andrieux (28 February 2020) François David (28 February 2020) Xavier de Sarrau (28 February 2020) Aline Sylla-Walbaum (17 August 2020) |

Guillaume Pepy (28 February 2020) Susan M. Tolson (28 February 2020) |

|

| Appointments, Remuneration and CSR Committee |

François David (28/02/2020) Hélène Molinari (28/02/2020) Aline Sylla-Walbaum (17/08/2020) |

Gilles Petit (appointed Chairman of the Committee on 28 February 2020) Jamal Benomar (28 February 2020) Aline Sylla-Walbaum (28 February 2020) Valérie Bernis (co-opted on 31 August 2020 with effect from 1 September 2020) |

|

| Strategy Committee | Guillaume Pépy (appointed Chairman of the Committee on 27 February 2020) Gilles Petit (27 February 2020) Nicolas Sarkozy (27 February 2020) Patrick Valroff (27 February 2020) |

Besides the changes recommended to the Annual General Meeting of 30 June 2021, no significant changes are planned to date in the composition of the Supervisory Board.

D) DIVERSITY

The Supervisory Board pays particular attention to its composition and to the composition of its Committees.

The Board has put in place a policy aimed at ensuring Board and Board Committee members have a broad range of skills (managerial, financial, strategic and/or legal), experience and knowledge of the Group’s businesses, as well as different age, gender, nationality and cultural profiles. This diversity is essential to the effectiveness of the Board’s work, guaranteeing high quality discussions and the proper performance of its supervisory duties. In order to put this policy into place, the Board has adopted a series of criteria for selecting members that mirror these goals, based on a recommendation of the Appointments, Remuneration and CSR Committee. The composition of the Supervisory Board and the Board Committees is reviewed each year by the Appointments, Remuneration and CSR Committee, which reports its findings to the Supervisory Board and puts forward recommendations in this regard.

Each year, the Board critically reviews its composition through the self-assessment procedure.

A formal description of this policy is provided below pursuant to article L. 22-10-10 of the French Commercial Code:

| Criteria | Objectives | Basis for implementation and 2020 results |

| Size of the Board | Maintain a reduced number of Supervisory Board members, including appointments required by law (employee representative member) to enable the Board to operate efficiently. | The size of the Board was reduced to a maximum of 12 members in 2018 as per the Company’s Articles of Association. In 2020, as part of amendments to the Articles of Association regarding the appointment of employee representative members, it was decided to keep the maximum number of members at 12, including two members representing the Group’s Employees. |

| Age limit | Pursuant to article 12 of the Articles of Association,no more than one-third of the members of the Supervisory Board in office may be over 75 years Old. | No Supervisory Board member in office was aged Over 75. |

| Gender balance | At least 40% of members are women, in accordance with article L. 22-10-74 of the French Commercial Code. | This threshold was met before the Annual General Meeting of 5 May 2020. The resolutions put forward to the General Meeting by the Supervisory Board relating to its composition (reappointment of members) respected this threshold. However, shareholders’ rejection of the resolution to reappoint Martine Chêne meant that the percentage of female members fell below 40%. On 31 August 2021, the Board decided to co-opt Valérie Bernis to replace Aline Sylla-Walbaum, who Resigned. |

| Availability | The availability of Supervisory Board members must be sufficient to allow the Board and its Committees to operate effectively. | In 2020, the average attendance rate of members at meetings of the Supervisory Board was 97% (92% for the Audit Committee and 100% for the Strategy Committee and the Appointments, Remuneration and CSR Committee). |

| Qualifications and professional experience Nationality, international Experience |

Members must have diverse profiles with senior management experience; financial, managerial, legal, social and CSR expertise; and knowledge of the Group’s businesses. They must have international experience and knowledge of the countries in which the Group conducts its business or in which it wishes to develop. | Appointment in 2020 of Nicolas Sarkozy and Guillaume Pepy (exceptional careers, unique expertise and in-depth knowledge of geopolitical and economic issues in the Group’s regions and business sectors) and of Valérie Bernis (recognised experience within large international groups and strong CSR expertise). The diagram below reflects this diversity. |

| Independence | At least half of members must be independent pursuant to the Afep-Medef Corporate Governance Code. (Code de gouvernement d’entreprise des sociétés cotées). | All Board members are independent |

| Employee representation on the Board | In accordance with the French “Pacte law” of 22 May 2019, two employee representative members must be appointed to the Board when the number of the other Board members (representing the shareholders) exceeds eight, and one employee representative member must be appointed when the number of the other Board members is equal to or less than eight. | The Annual General Meeting of 5 May 2020 amended the Articles of Association to provide for the appointment to the Supervisory Board of employee representative members by the Group Employees’ Committee. The Group Employees’ Committee appointed Michel Defer on 4 November 2020. |

Therefore, Supervisory Board has a combination of expertise, experience and valuable skills. This is the result of a demanding and transparent review and selection process, which enables it to fulfil its role and responsibilities, wholly independently of the Managing Partners.

- Guillaume Pepy, Gilles Petit, Nicolas Sarkozy, Aline Sylla-Walbaum, Susan M. Tolson provide business and other expertise, international experience as well as senior executive experience or financial expertise.

- Jamal Benomar provides international experience.

- Patrick Valroff provides senior executive experience and financial expertise

- Michel Defer and Soumia Malinbaum provide business and other expertise.

- Valérie Bernis provide senior executive experience or financial expertise as well as business and other expertise.

(*) Media/Distribution/Innovation/New technologies/Travel Retail.

(**) Legal/Governance/Social relations/Diversity.

In view of its supervisory duties, the Board must have a majority of independent members.

At its meeting on 30 March 2021, the Appointments, Remuneration and CSR Committee therefore reviewed the situation of each of the Supervisory Board members.

In particular, the Committee considered that the volume of business assigned to the Realyze law firm and the attendant fees paid to that firm are not material to the Group or to Realize (it being specified that Nicolas Sarkozy himself does not provide any legal advisory services to the Group), and that accordingly, Nicolas Sarkozy qualifies as an independent member.

Based on this review, it was concluded that all members, except for the employee representative, qualify as independent members in the light of the criteria for independence, applied by the Supervisory Board and stipulated in the Afep-Medef Corporate Governance Code, which it has used as a benchmark framework for analysis (see table below).

Summary table of Supervisory Board members’ compliance with the independence criteria set out in the Afep-Medef Corporate Governance Code at 31 December 2020

| P. Valroff | J. Benomar | V. Bernis | M. Defer (*) | S. Malinbaum | G. Pepy | G. Petit | N. Sarkozy | S. M. Tolson | |||||

| Independence criteria set out in the Afep-Medef Corporate Governance Code and applied by the Supervisory Board | |||||||||||||

| Not to be and not to have been in the previous five years, (i) an employee or executive corporate officer of the Company, (ii) an employee, executive corporate officer or a director of an entity that is consolidated within the Company, or (iii) an employee, executive corporate officer or a director of the Company’s parent company or an entity consolidated within that parent company. | ✓ | ✓ | ✓ | N/A | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| Not to be an executive corporate officer of an entity in which the Company holds a directorship, directly or indirectly, or in which an employee appointed as such or an executive corporate officer of the Company (currently in office or having held such office within the last five years) holds a directorship. | ✓ | ✓ | ✓ | N/A | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| Not to have any ties, directly or indirectly, with a customer, supplier, investment banker, commercial banker or consultant: - that is significant to the Company or the Group - or for which the Company or the Group represents a significant proportion of its activities. |

✓ | ✓ | ✓ | N/A | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| Not to be related by close family ties to a Managing Partner. | ✓ | ✓ | ✓ | N/A | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| Not to have been a Statutory Auditor of the Company within the previous five years. | ✓ | ✓ | ✓ | N/A | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| Directors representing major shareholders of the Company or its parent may be considered as independent provided that these shareholders do not take part in control of the Company. Nevertheless, beyond a 10% threshold in capital or voting rights, the Board, upon a report by the Appointments Committee, should systematically review the qualification of a director as independent, in light of the make-up of the Company’s capital and the existence of a potential conflict of interest. | ✓ | ✓ | ✓ | N/A | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| Not to receive variable remuneration in cash or in the form of shares or any other remuneration linked to the performance of the Company or Group. | ✓ | N/A | |||||||||||

| Conclusion | Independent | Independent | Independent | N/A | Independent | Independent | Independent | Independent | Independent | ||||

| Independence criteria set out in the Afep-Medef Corporate Governance Code and not applied by the Supervisory Board | |||||||||||||

| Not to have been a member of the Supervisory Board for more than 12 years. | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

(*) Employee representative Supervisory Board member

2.3.2 BOARD’S INTERNAL RULES AND OPERATION

The terms and conditions of the Supervisory Board’s organisation and operations are set out in its internal rules, which also define the duties incumbent on each member and the code of professional ethics each individual member is bound to respect. These internal rules are updated regularly, most recently on 28 February 2020. These rules concern the following:

- The independence of Board members: the minimum quota for independent members is fixed at half of the total serving members. Independent members must have no direct or indirect relations of any kind with the Company, the Group or its Management that could compromise their freedom of judgement or participation in the work of the Board. It lists a number of criteria, which form a framework for determining whether or not a member may be considered independent;

- The annual number of meetings: a schedule for the coming year is fixed annually, based on a proposal by the Chairman;

- The duties of each member: apart from the fundamental duties of loyalty, confidentiality and diligence, members’ obligations also concern knowledge of the law, regulations and statutory provisions, ownership of a significant number of shares, declaration to the Board of any conflict of interest and regular attendance at meetings;

-

Trading in shares of the Company and its subsidiaries: as Board members have access to inside information and in-depth knowledge on certain aspects of the life of the Company and Group, they are expected to refrain from trading in Company shares, except within the following restrictions contained in the Board’s internal rules:

- no trading in shares may take place during certain defined periods,

- it is recommended that acquisitions should take place once a year, at the end of the Annual General Meeting, in the form of a block purchase carried out through the Company by each Board member,

- the General Secretariat of Lagardère SCA and the French financial markets authority (Autorité des marchés financiers – AMF) must be informed of any transactions in shares within three days of their completion;

- The existence of three committees: the Audit Committee; the Appointments, Remuneration and CSR Committee; and the Strategy Committee: in addition to the tasks described below, these committees are responsible for preparing topics for discussion at Board meetings that fall within their remit.

In accordance with the provisions introduced by the “Pacte law” in France, the Supervisory Board approved an Internal Charter on the procedure for identifying related-party agreements subject to the monitoring procedure set out in the French Commercial Code.

Any agreements considered susceptible to meeting the definition of a related-party agreement are submitted prior to signature to the General Secretariat, who determines their classification in light of the criteria set out in the charter. Agreements are regularly reviewed, particularly in the event they are amended, renewed or terminated, to ensure that the specified criteria continue to be met.

2.3.3 2020 WORK SCHEDULE

The Supervisory Board meets regularly to review the financial position and operations of the Company and its subsidiaries, the annual and interim financial statements, the outlook for each of the business activities taking into account corporate social responsibility issues, as well as the Group’s strategy. During these meetings, the Committees report to the Board on their work. The Supervisory Board defines an annual schedule for its meetings, six of which are planned for 2021.

During 2020, the Supervisory Board met ten times with an average attendance rate of 97%.

Members of the Board closely monitored the impacts of the Covid-19 crisis on the Group’s businesses, along with the action plans put in place to address these impacts.

The other work carried out by the Supervisory Board during the year mainly concerned:

-

Group business and finance:

- reviewing the annual and interim financial statements and the Group’s general situation and strategy;

- presenting the new strategic roadmap adopted by the Managing Partners.

-

Governance, appointments and remuneration:

- reviewing the findings of the independent expert as regards the assessment of the Supervisory Board;

- setting up a Strategy Committee and updating the Supervisory Board’s internal rules;

- changing the composition of the Board’s Committees; – co-opting as Nicolas Sarkozy and Guillaume Pepy Supervisory Board members to replace Xavier de Sarrau and François David, who resigned from the Board;

- providing an advisory opinion on the Managing Partner remuneration policy;

- designing the remuneration policy for the members of the Supervisory Board;

- conducting the annual review of the Service Agreement, which remained in force during the year;

- preparing the charter to identify related-party agreements;

- preparing the Annual General Meeting of 5 May 2020, drafting the report on corporate governance and the report to the shareholders;

- providing an opinion on the draft resolutions proposed by Amber Capital to the Annual General Meeting of 5 May 2020;

- co-opting Valérie Bernis to replace Aline Sylla-Walbaum;

- presenting the findings of the working group responsible for reviewing the Group’s succession plans.

-

Opinions, approvals and other duties:

- reviewing the proposed partnership between Lagardère Capital & Management and Groupe Arnault;

- approving the re-appointment of Arnaud Lagardère as Managing Partner for a period of four years;

- reviewing the request for calling a General Meeting submitted by Amber Capital and Vivendi.

-

Corporate social responsibility:

- reviewing the Group’s CSR roadmap.

The Supervisory Board’s annual seminar could not be held in 2020 due to the Covid-19 pandemic. However, immediately after the Supervisory Board meeting on 27 February 2020, the Board members held a separate meeting without the Managing Partners attending.

In addition to his traditional duties, the Chairman of the Supervisory Board also performs other specific services in view of his professional experience. The Group considers it beneficial not only to draw on his opinions on matters within the traditional remit of the Supervisory Board, but also to engage in a regular dialogue that affords him a better understanding of the key events and developments impacting the Group, so that he can, in turn, share that insight with the other members of the Board. As such, he may be consulted by General Management on certain key or strategic events for the Group. The Chairman of the Supervisory Board must also ensure the appropriate balance between advising, taking part in the process for appointing and renewing the Board, and ensuring that any comments expressed by members of the Board, especially in meetings in which the Managing Partners are not present, are dealt with adequately.

In 2020, these duties gave rise to numerous meetings with the Managing Partners, the Finance Department, the division senior executives and the Statutory Auditors, as well as to working sessions with the Internal Audit Department and the Risk, Compliance and Internal Control Department. The Chairman of the Supervisory Board is responsible for any dealings between shareholders and the Board.

Members’ attendance at Supervisory Board and Committee meetings in 2020 (for members in office at December 31, 2020)

| Member of the Board | Supervisory Board meetings | Audit Committee meetings | Appointments, Remuneration and CSR Committee | Strategy Committee |

| Jamal Benomar | 90 % | - | 100 % | - |

| Valérie Bernis | 100 % | - | 100 % | - |

| Michel Defer | 100 % | - | - | - |

| Soumia Malinbaum | 100 % | - | 100 % | - |

| Guillaume Pepy | 100 % | 100 % | - | 100 % |

| Gilles Petit | 100 % | - | 100 % | 100 % |

| Nicolas Sarkozy | 89 % | - | - | 100 % |

| Susan M. Tolson | 100 % | 100 % | - | - |

| Patrick Valroff | 100 % | 100 % | - | 100 % |

2.3.4 SUPERVISORY BOARD COMMITTEES

A) AUDIT COMMITTEE

| Members | ► Patrick Valroff (Chairman) ► Guillaume Pepy ► Susan M. Tolson |

|

| Audit Committee members are appointed for their financial and/or accounting skills, assessed with particular regard to their past career (positions held in general or financial management or in an audit firm), academic background or specific knowledge of the Company’s business. The expert knowledge of the members of the Audit Committee is described in section 2.3.1 of the Universal Registration Document. At 31 December 2020, all of the Audit Committee’s members were independent (see table above). | ||

| Main tasks | The Committee applies all of the recommendations contained in the AMF working group’s report of 22 July 2010, with the exception of those that it does not deem relevant with regard in particular to the tasks specific to a Supervisory Board of a French partnership limited by shares, and thereby: ► reviews the accounts and the consistency of the accounting methods used for the Lagardère SCA parent company and consolidated financial statements, and monitors the process for preparing financial information; ► monitors the audit of the parent company and consolidated financial statements by the Statutory Auditors; ► monitors the Statutory Auditors’ independence; ► issues a recommendation on the Statutory Auditors nominated for re-appointment at the General Meeting; ► monitors the effectiveness of internal control and risk management systems and where applicable internal audit, as regards accounting and financial reporting procedures; ► ensures that the Company has internal control and risk management procedures, particularly procedures for (i) risk assessment and management, and (ii) compliance of Lagardère SCA and its subsidiaries with the main regulations applicable to them. The Audit Committee is informed of any observations and/or suggestions from the Statutory Auditors regarding these internal control procedures; ► monitors the implementation of measures to prevent and detect corruption; ► examines all matters pertaining to the internal auditing of the Company and its activities, the audit plan, organisation, operation and implementation; ► reviews agreements directly or indirectly linking the Group and the senior executives of Lagardère SCA. Readers are reminded that the executive corporate officers’ salaries are paid by Lagardère Management, which is bound to the Group by a Service Agreement. The appropriate application of this agreement, which has been approved by the Board and the shareholders as a related-party agreement, is monitored regularly. The Board has delegated this task to the Audit Committee, which includes the amount of expenses reinvoiced under the contract, essentially comprising the Managing Partners’ remuneration. The Chairman of the Audit Committee reports to the members of the Board on the work conducted by the Audit Committee. The members of the Audit Committee interview the Group’s key senior executives when necessary, and the Statutory Auditors also present a report on their work. In addition, Audit Committee members reserve the right to interview the Statutory Auditors without Management in attendance and to consult external experts. |

|

| Main activities in 2020 | The Audit Committee met seven times in 2020 with an attendance rate of 92%, it being specified that two meetings to review the annual and interim financial statements were held several days before the Supervisory Board’s meetings. During 2020, the Committee: ► reviewed (i) the impairment tests performed on intangible assets for the purposes of the financial statements at 31 December 2019, (ii) the consolidated financial statements for 2019 and the first half of 2020, (iii) the Company’s dividend coverage, and (iv) the presentation of the budget for 2021, 2022 and 2023, and the Group’s cash management and cost-savings plans; ► reviewed the renewal of the term of office of Mazars as Statutory Auditor and examined the Statutory Auditors’ fees. The Auditors gave the Committee a presentation on the code of conduct and independence rules applicable to their profession and set out their audit plan for the coming year; ► assessed the relations with Lagardère Capital & Management (LC&M); ► analysed the work carried out by the Internal Audit Department in the first and second half of 2020 as well as the 2021 internal audit plan; ► was given a presentation on (i) the organisation of risk and internal control oversight within the Group, (ii) the Group’s risk map and internal control systems, (iii) the results of the internal control self-assessment, (iv) a follow-up of risk management actions undertaken, and (v) a draft risk management charter; ► analysed the processes for validating planned acquisitions and divestments; updated the Group’s commitments procedure; examined the Group’s financing policy and information systems security policy; verified the progress of the compliance program; and reviewed the Group’s legal disputes; ► examined Lagardère Travel Retail’s report on its sales activity with Auckland airport. The Audit Committee also held exceptional meetings during the year where it was given detailed presentations of the impacts of the Covid-19 pandemic on the Group’s operations, particularly for Lagardère Travel Retail. The Committee also reviewed the Group’s financial communications, dividend, financing and liquidity position in the context of the pandemic. The Audit Committee meetings were attended by the Chief Financial Officer, the Internal Audit Director, the Head of Risk Management, Compliance and Internal Control, the Accounting Director, the Group Management Control Director and the Statutory Auditors. Depending on the issues discussed, other executives were asked to provide input on an as-needed basis, including the Secretary General, the Group IT Director, the Group General Counsel, the Head of Financing and Investor Relations, and the executive management of Lagardère Travel Retail, as well as certain members of their teams. |

|

B) STRATEGY COMMITTEE

| Members | ► Guillaume Pepy (Chairman) ► Gilles Petit ► Nicolas Sarkozy ► Patrick Valroff At 31 December 2020, all of the Strategy Committee’s members were independent (see table above). |

| Main tasks | The Strategy Committee is responsible for assisting the Supervisory Board in preparing and supporting its work on the ex-post supervision of business operations. In this respect, it receives all necessary information from the Managing Partners on: ► the Group’s main strategic focuses; ► market trends, the competitive environment and the key strategic challenges facing the Group, as well as the resulting medium- and long-term outlook; ► major investments and divestments that individually represent more than €100 million and are to be carried out in line with the aforementioned strategic focuses; and ► any transactions likely to significantly change the Group’s scope, business or financial structure. The Chairman of the Strategy Committee reports to (or instructs someone to report to) the members of the Board on the work conducted by the Committee. |

| Main activities in 2020 | The Strategy Committee met seven times in 2020, with an attendance rate of 100%. During its meetings, the Committee reviewed the financial situation of the Group’s operations and cash >position, as well as Lagardère SCA’s shareholder structure. It also examined the new strategic roadmap, assessed the Managing Partners’ performance and recommended that Arnaud Lagardère be re-appointed as Managing Partner before the end of his term of office. With regard to the businesses, it reviewed in particular the progress of Lagardère News’ radio operations and the Lagardère Travel Retail division. It also reviewed planned acquisitions and divestments, especially the planned disposal of Lagardère Studios and a projected acquisition at Lagardère Publishing (upstream review of bid). Depending on the issues discussed, the meetings were attended by the Group Chief Financial Officer and by the senior executives of the divisions concerned. The Chairman of the Strategy Committee reports to the Board on the work conducted and opinions given by the Committee. |

C) APPOINTMENTS, REMUNERATION AND CSR COMMITTEE

| Members |

► Gilles Petit (Chairman) ► Jamal Benomar ► Valérie Bernis ► Soumia Malinbaum At 31 December 2020, all of the Appointments, Remuneration and CSR Committee’s members were independent (see table above). |

| Main tasks | ► Regarding Board and Committee membership:– defining the selection criteria for future members; – selecting and recommending Supervisory Board and Committee candidates to the Supervisory Board. ► Regarding remuneration: – issuing an advisory opinion on the remuneration policy for the Managing Partners, approved by the General Partners; – monitoring, where relevant, any other components of remuneration allocated to the Managing Partners, in accordance with the remuneration policy; – proposing the overall amount of annual remuneration allocated to members of the Supervisory Board, which is submitted to the General Meeting for approval; – proposing the remuneration policy applicable to members of the Supervisory Board and its Committees, which is submitted to the General Meeting for approval. ► Regarding governance: – issuing its opinion to the Supervisory Board concerning the appointment or re-appointment of the Managing Partners proposed by the General Partners; – regularly reviewing the independence of Supervisory Board members in light of the independence criteria defined by the Supervisory Board; – managing the annual assessment of the operations of the Board and its Committees; – carrying out advance assessments of potential risks of conflicts of interest between Supervisory Board members and the Lagardère group; – reviewing the anti-discrimination and diversity policy implemented by the Managing Partners, notably as regards the principle of balanced representation of women and men within the Group’s managing bodies. ► Regarding sustainable development (CSR): – examining the main corporate, environmental and social risks and opportunities for the Group as well as the CSR policy in place; – reviewing the reporting, assessment and monitoring systems allowing the Group to prepare reliable ESG data; – examining the Group’s main lines of communication with shareholders and other stakeholders regarding corporate social responsibility matters; – examining and monitoring the Group’s rankings attributed by ESG rating agencies. The members of the Committee interview the Chairman of the Supervisory Board, the executive corporate officers or any other person of their choice when necessary. The Chairman of the Committee reports to the members of the Board on the work conducted by the Committee. |

| Main activities in 2020 | The Appointments, Remuneration and CSR Committee met seven times in 2020 with a 100% attendance rate. The main work carried out by the Committee during its meetings concerned the following: ► reviewing and drawing up the remuneration policies for the Managing Partners and the Supervisory Board members and preparing the corporate governance report; ► reviewing the Supervisory Board’s membership structure and the independence status of its members,and putting forward recommendations to the Board about the re-appointment of existing members and the appointment of new members; ► working on the organisational and administrative aspects of the Board Committees: proposing the creation of a Strategy Committee, making changes to the Committees’ membership structure and amending the internal rules of the Supervisory Board; ► preparing an opinion for the Supervisory Board on the resolutions put forward by Amber Capital at the General Meeting; ► reviewing (i) Arnaud Lagardère’s performance during his term of office as Managing Partner,(ii) the presentation of the new medium-term strategic plan, and (iii) the recommendation that Arnaud Lagardère be re-appointed as Managing Partner for a four-year term; ► analysing the presentation of the findings of a study carried out by two Supervisory Board members on the Group’s succession plans; ► carrying out an annual progress review for 2020 on the Group’s CSR roadmap and reviewing the process used for preparing non-financial information; ► being given a presentation on (i) the diversity and anti-discrimination policy in place within the Group’s management bodies and (ii) the Group’s corporate sponsorship policy. These meetings took place in the presence of the Group Secretary General and, when discussions fell within their areas of expertise, the Corporate Social Responsibility Director, the Deputy Director of Non-Financial Reporting and Environmental Responsibility, the Group Human Relations Director, and the Head of Corporate Law/Securities Law. |

2.3.5 ASSESSMENT OF THE SUPERVISORY BOARD’S MEMBERSHIP STRUCTURE AND OPERATING PROCEDURES

Since 2009, the Supervisory Board has carried out an annual assessment of the operating procedures of the Board and its Committees in order to form an opinion on the preparation and quality of their work. Every three years, this assessment is performed by an independent consulting firm.

In this context, the Supervisory Board commissioned an independent consulting firm to carry out an external assessment in 2019, overseen by the Appointments, Remuneration and CSR Committee. The findings were presented to the Supervisory Board on 4 December 2019 and 27 February 2020.

The assessment mainly concerned the Board’s membership, as well as its operation, the organisation of its meetings, access to information, the agenda and work, the amount and distribution of attendance fees, and relations between the Board and the Managing Partners. These issues were also addressed with regard to the Committees.

Members also assessed their own individual contributions. The members of the Supervisory Board voted unanimously to maintain the current modus operandi and not to require them to complete a formal questionnaire specifically designed to systematically assess the contribution of their fellow members.

The members were mostly very satisfied with the membership, organisation and operation of the Board and its Committees. There was an improvement in the Board’s operation and performance and attendance at meetings was very satisfactory. The Board’s seminar, the topics and analyses presented, as well as the participants involved proved especially popular. The main areas that the Board members felt could be improved were (i) setting up a Strategy Committee, (ii) creating new working groups and (ii) receiving more information before meetings. There was a recommendation that certain senior executives could be asked to participate more often by the Committees and provide their input in meetings, in line with the items on the agenda.

As the findings of the assessment were presented to the Supervisory Board in February 2020, in view of the unprecedented conditions in which the Board had to work in 2020 as well as the major changes in its membership structure during the year, it was decided to carry out the next self-assessment process after the 2021 Annual General Meeting.

2.3.6 COMPLIANCE WITH FRENCH CORPORATE GOVERNANCE REGULATIONS – AFEP-MEDEF

The Company has applied the corporate governance principles laid down in the Afep-Medef Corporate Governance Code revised in January 2020. This code is available in the Corporate Governance section of Lagardère’s website.

As stated in the introduction to the Code, most of the recommendations it contains have been established with reference to joint-stock companies with a board of directors. Companies with an executive board and supervisory board, and partnerships limited by shares, need to make adjustments as appropriate in order to implement the recommendations. By its very principle, a partnership limited by shares has a strict separation of powers between the Managing Partners who run the company (and thereby the General Partners who have unlimited liability), and the Supervisory Board, which reviews management actions ex-post but does not actively participate in management.

Given Lagardère SCA’s specificities in terms of French law and its own Articles of Association as a partnership limited by shares, the Board has adopted an organisational structure which is appropriate to the nature of its work in accordance the law and the recommendations of the Afep-Medef Corporate Governance Code.

| Provision of the Afep-Medef Corporate Governance Code set aside or partially applied |

Explanation |

| Independence criteria | |

| “Not to have been a director of the corporation for more than 12 years” |

It is considered that being a Board member for more than 12 years does not disqualify a member as an independent member. On the contrary, it is considered an asset in a control role within a diverse group where it inevitably takes longer to build up in-depth knowledge of the different business lines and their competitive environment and to develop a strong command of the related strategic challenges. Moreover, the members of the Supervisory Board consider a long period of service to be a positive factor that does not alter an independent member’s judgement, moral standards or ability to freely express their views. However, no current Supervisory Board member has been on the Board for more than 12 years. |

| Remuneration Committee: “It is recommended [...] that one of its members should be an employee director” |

As the employee representative member was only appointed on 4 November 2020, the Supervisory Board has not yet decided which committee the employee representative will join and how the Committees’ membership structure will change as a result. |