2.4 Remuneration and benefits of executive corporate officers

Commercial Code introduced by French Government Order no. 2019-1234 of 27 November 2019 concerning the remuneration of corporate officers in listed companies provide for a single, strict legal framework for the remuneration of the Managing Partners and Supervisory Board members.

The purpose of this section is therefore to present (i) the remuneration policy for the Company’s executive corporate officers and (ii) the components of the total remuneration and benefits paid during or allocated in respect of 2020 to these corporate officers. This remuneration policy and the components of the executive corporate officers’ remuneration packages will be submitted for shareholder approval at the Annual General Meeting to be held on 30 June 2021.

In applying the Afep-Medef Corporate Governance Code (the “Afep-Medef Code”) – which the Company uses as its corporate governance framework – Lagardère has opted to use a wide interpretation of the term “executive corporate officer” as it has always applied the corresponding recommendations contained in the Code, not only for Arnaud Lagardère, in his capacity as a Managing Partner of Lagardère SCA, but also for the Chief Operating Officers of Arjil Commanditée-Arco, Lagardère SCA’s other Managing Partner.

The descriptions and explanations that follow therefore concern:

- Arnaud Lagardère, in his capacity as Managing Partner of Lagardère SCA and Chairman and Chief Executive Officer of Arjil Commanditée-Arco, Managing Partner of Lagardère SCA;

- Pierre Leroy, in his capacity as Vice-Chairman and Chief Operating Officer of Arjil Commanditée-Arco, Managing Partner of Lagardère SCA; and

- Thierry Funck-Brentano, in his capacity as Chief Operating Officer of Arjil Commanditée-Arco, Managing Partner of Lagardère SCA. Arnaud Lagardère, Pierre Leroy and Thierry Funck Brentano are “executive corporate officers” of the Company and are referred to as such below.

2.4.1 REMUNERATION POLICY FOR EXECUTIVE CORPORATE OFFICERS

2.4.1.1 UNDERLYING PRINCIPLES OF THE REMUNERATION POLICY FOR EXECUTIVE CORPORATE OFFICERSIn accordance with the legal framework set out in articles L. 22-10-75 et seq. of the French Commercial Code, the remuneration policy applicable to the executive corporate officers was approved by the General Partners on the advice issued by the Appointments, Remuneration and CSR Committee and by the Supervisory Board at their respective meetings of 30 March and 26 April 2021.

The contribution of the Supervisory Board and Appointments, Remuneration and CSR Committee, comprising only independent members, ensures that there are no conflicts of interest when preparing, reviewing and implementing the remuneration policy.

This procedure will be identical for any subsequent revision of the remuneration policy.

Most of the main principles underlying the remuneration policy for Lagardère SCA’s executive corporate officers were set in 2003 and have been applied consistently since that date.

However, the different components of the remuneration policy are regularly reviewed and reassessed as part of the work performed by the General Partners and submitted to the Appointments, Remuneration and CSR Committee to ensure that they best reflect (i) changes in corporate governance best practices, including the recommendations of the Afep-Medef Corporate Governance Code, the French financial markets authority (Autorité des marchés financiers – AMF) and the French High Commission for Corporate Governance (Haut Comité de Gouvernement d’Entreprise), (ii) market practices as observed in the benchmarking of SBF120 companies or of comparable companies in the industries in which the Group operates, and (iii) observations and remarks that may be made to the Company within the scope of its dialogue with its shareholders and proxy advisory firms.

The aim of the remuneration policy is to achieve – through its various components – a fair balance, commensurate with the work performed and the level of responsibility, between a lump-sum, recurring portion (annual fixed remuneration), and a portion directly related to the operating environment, strategy and performance of the Group (annual variable remuneration and performance shares).

Within the variable portion, a balance is also sought between the portion based on short-term objectives (annual variable remuneration contingent on performance for the year concerned) and the portion based on long-term objectives (free shares subject to performance conditions assessed over a minimum period of three consecutive years, with the vesting period followed by a holding period of no less than two years).

The aim of these performance share awards is to closely align the executive corporate officers’ interests with those of the Company’s shareholders in terms of long-term value creation.

The underlying performance criteria applicable to both the annual variable remuneration and the performance shares are mainly quantitative financial criteria, which are key indicators of the Group’s overall health. These criteria are a way of assessing the Group’s intrinsic performance, i.e., its year-on-year progress, based on internal indicators that are directly correlated with the Group’s strategy.

The variable remuneration of the Group’s executive corporate officers is also contingent on quantitative non-financial criteria related to the Group’s key commitments under its Corporate Social Responsibility policy, which apply both to the short-term portion (annual variable remuneration) and the long-term portion (performance shares). The inclusion of these non financial criteria is designed to encourage a model of steady, sustainable growth that mirrors the Group’s corporate values and respects the environment in which it operates.

With the exception of Arnaud Lagardère, the annual variable remuneration of executive corporate officers also includes a minority portion contingent on qualitative criteria, based on a set of specific priority targets assigned to them each year.

In addition, executive corporate officers have a conditional right to receive a supplementary pension in addition to benefits under the basic state pension system. This benefit is taken into account when calculating their overall remuneration.

Lastly, on a very exceptional basis, bonuses may be awarded, under terms and conditions that always comply with best corporate governance principles and practices.

In light of all these elements, executive corporate officers do not receive:

- multi-annual variable remuneration in cash;

- remuneration for any office held within the Group;

- benefits linked to taking up or terminating office;

- benefits linked to non-competition agreements.

Furthermore, Arnaud Lagardère, who is a significant shareholder of Lagardère SCA, does not receive any free share awards or other share options, as his stake in the Company automatically guarantees that his actions over the long term will be closely aligned with the interests of shareholders, of which he is one.

Beyond the application of market practices, the remuneration policy for executive corporate officers takes account of the remuneration and employment conditions of Company and Group personnel. Accordingly, around 40% of Group employees have a variable component in their overall annual remuneration.

Similarly, in accordance with best corporate governance practices, the Lagardère SCA free share plans are not just restricted to executive corporate officers and senior managers. They also cover over 400 Group employees, notably young high-potential managers identified during the talent management process. In addition, for a portion of the beneficiaries of these plans, free shares are allocated subject to the achievement of the same performance conditions as those applicable to the executive corporate officers.

As noted in the advice issued by the Supervisory Board and the Appointments, Remuneration and CSR Committee, the policy ensures reasonable, fair and balanced remuneration, with a strong correlation between the interests of the executive corporate officers and the interests of the Company, its shareholders and all of its stakeholders, in line with the Group’s strategy and its performance objectives.

In accordance with the second paragraph of article L. 22-10-76, III of the French Commercial Code, exceptions may be decided as to the application of the remuneration policy by modifying, on the advice of the Appointments, Remuneration and CSR Committee, the objectives set for certain criteria applicable to the executive corporate officers’ annual variable remuneration or long-term incentive instruments, provided that any such modification is justified by exceptional circumstances, such as a change in accounting standards, a material change in scope, the completion of a transformational transaction, a substantial change in market conditions or an unexpected development in the competitive landscape. Any such modification of the objectives, which would aim to ensure that the application of the criteria continues to reflect the actual performance of the Group and of the executive corporate officer, would be made public and justified, notably with regard to the Group’s corporate and long-term interests. In all circumstances, the payment of variable remuneration remains subject to the approval of the shareholders.

2.4.1.2 COMPONENTS OF THE REMUNERATION POLICY FOR EXECUTIVE CORPORATE OFFICERS

2.4.1.2.A SHORT-TERM REMUNERATION COMPONENTS

A) Annual fixed remuneration

Annual fixed remuneration is paid in 12 equal monthly instalments over the year.

The amount of this fixed remuneration reflects the responsibilities, skills and experience of each executive corporate officer, and is reviewed at relatively long intervals in accordance with the recommendations of the Afep-Medef Code.

Arnaud Lagardère receives €1,140,729 in annual fixed remuneration, unchanged since 2009.

Pierre Leroy receives €1,474,000 in annual fixed remuneration, unchanged since 2011.

Thierry Funck-Brentano receives €1,206,000 in annual fixed remuneration, unchanged since 2011.

B) Annual variable remuneration

Annual variable remuneration is calculated as a portion of a benchmark amount set for each executive corporate officer, based on a combination of specific criteria – both financial and nonfinancial – directly correlated with the Group’s strategy. Annual variable remuneration is also subject to a cap expressed as a maximum percentage of fixed remuneration for the same fiscal year.

In accordance with article L. 22-10-77 II of the French Commercial Code, the variable remuneration of the executive corporate officers can only be paid following the approval of the General Meeting of shareholders and of the General Partners.

Benchmark amounts, weighting of criteria and caps

For Arnaud Lagardère – who receives neither variable remuneration based on qualitative criteria nor share options or performance shares – his annual variable remuneration is based on a benchmark amount of €1,400,000 (i.e., 123% of his annual fixed remuneration) which has remained unchanged for several years.

Only quantitative criteria are applied to this benchmark amount, breaking down as financial criteria (accounting for 75%) and non-financial CSR criteria (accounting for 25%).

His annual variable remuneration may not exceed 150% of his annual fixed remuneration.

The annual variable remuneration for the other executive corporate officers is based on an aggregate benchmark amount of €600,000 (i.e., 41% of Pierre Leroy’s fixed remuneration and 50% of Thierry Funck-Brentano’s fixed remuneration). This amount has remained unchanged for several years.

This benchmark amount takes into account quantitative financial criteria, breaking down as financial criteria (accounting for 50%), non-financial CSR criteria (25%), and qualitative criteria (25%). Annual variable remuneration is therefore mostly (i.e., 75%) based on quantitative criteria. This is more than the weighting in the previous remuneration policy, when it accounted for 66%.

The annual variable remuneration of the Co-Managing Partners is also subject to a dual cap: for both of these executive corporate officers, their annual variable remuneration may not exceed 75% of their annual fixed remuneration, and the amount of the qualitative portion is capped at 25% of their annual fixed remuneration. The qualitative portion may not therefore represent more than 33% of their maximum annual variable remuneration.

Quantitative financial criteria

The quantitative financial criteria underlying the executive corporate officers’ annual variable remuneration correspond to two internal criteria which have an equal weighting. These criteria reflect key indicators of the Group’s solidity:

- recurring operating profit of fully consolidated companies (recurring EBIT);

- free cash flow.

These criteria have been modified compared to the previous remuneration policy in order to reflect both (i) the impact of the Covid-19 crisis on the Group’s traditional performance indicators, and (ii) the new strategic roadmap adapted to take into account the impacts of this crisis as defined in 2020.

For each of these two criteria, the General Partners validate, on the advice issued by the Appointments, Remuneration and CSR Committee and by the Supervisory Board, the “trigger level” and “target level” for the objectives, in line with the Group’s provisional consolidated budget.

For each of these two criteria:

- if the target level is achieved, 100% of the benchmark amount allocated to the criterion will be awarded;

- if the level achieved is between the trigger and target levels, 0% to 100% of the benchmark amount allocated to the criterion will be awarded, as calculated on a straight-line basis;

- if the target level is exceeded, the award is proportionate to the outperformance, but cannot exceed the specified aggregate annual variable remuneration cap;

- if the trigger level is not achieved, 0% of the benchmark amount allocated to the criterion is awarded.

Quantitative non-financial CSR criteria

Four quantitative non-financial CSR criteria underline executive corporate officers’ annual variable remuneration, each with an equal weighting. The criteria are related to the Group’s priority commitments under its Corporate Social Responsibility policy.

Each of the four criteria used must be relevant to the Group’s CSR roadmap, be measurable and monitored over time using reliable systems, and be subject to specific procedures carried out by the independent third party in the context of its report on the Group’s non-financial statement, except for external criteria based on assessments performed by an independent third party.

Each of the criteria is set by the General Partners on the basis of proposals put forward by the Sustainable Development Department, on the advice of the Appointments, Remuneration and CSR Committee and of the Supervisory Board.

For each of the four criteria, trigger level and target level objectives are set under the same conditions. These targets must be demanding and consistent in terms of both the Group’s historic performance and changes in its operating environment, notably in connection with its strategic refocusing.

For each of these four criteria:

- if the target level is achieved, 125% of the benchmark amount allocated to the criterion will be awarded;

- if the level achieved is between the trigger and target levels, 75% of the benchmark amount allocated to the criterion will be awarded; ? if the target level is exceeded, 150% of the benchmark amount allocated to the criterion will be awarded;

- if the trigger level is not achieved, 0% of the benchmark amount allocated to the criterion is awarded.

This system is set to evolve in 2022, with the four specific criteria listed above replaced by an internal CSR composite index covering a wider scope of indicators tracking the implementation of the Group’s CSR strategy and performance.

Qualitative criteria

The qual itative criteria that apply to the executive corporate officers’ remuneration (with the exception of Arnaud Lagardère) are based on the following two areas, each with equal weighting:

- rollout of the Group’s strategic plan;

- quality of governance and management.

The performance levels achieved in these two areas are directly assessed by Arnaud Lagardère based on reports prepared by the relevant technical departments.

The performance level achieved – which is also submitted for approval to the Appointments, Remuneration and CSR Committee and Supervisory Board – can raise or lower the benchmark amount, although the qualitative portion of annual variable remuneration may not under any circumstances exceed 25% of the executive corporate officer’s fixed remuneration for a given year.

Summary presentation of the annual variable remuneration structure

| Managing Partner | Co-Managing Partners | |||||

| Weighting | Benchmark Amount |

Maximum amount (% of fixed remuneration) |

Weighting | Benchmark amount |

Maximum amount (% of fixed remuneration) |

|

| Quantitative financial criteria | 75 % | €1,050,000 | 150 % | 50 % | €300,000 | |

| Recurring operating profit of fully consolidated companies | 37.5 % | €525,000 | 25 % | €150,000 | ||

| Free cash flow | 37.5 % | €525,000 | 25 % | €150,000 | ||

| Quantitative CSR criteria | 25 % | €350,000 | 25 % | €150,000 | ||

| Criterion 1 | 6.25 % | €87,500 | 6.25 % | €37,500 | ||

| Criterion 2 | 6.25 % | €87,500 | 6.25 % | €37,500 | ||

| Criterion 3 | 6.25 % | €87,500 | 6.25 % | €37,500 | ||

| Criterion 4 | 6.25 % | €87,500 | 6.25 % | €37,500 | ||

| Qualitative criteria | - | - | - | 25 % | €150,000 | 25 % |

| Strategic plan | 12.5 % | €75,000 | ||||

| Quality of management | 12.5 % | €75,000 | ||||

| Total | 100 % | €1,400,000 | 150 % | 100 % | €600,000 | 75 % |

“Clawback clause”

The General Partners decided, following approval of the Appointments, Remuneration and CSR Committee and of the Supervisory Board, to introduce a clawback clause in the remuneration policy. This clause allows some or all of the annual variable remuneration paid to the executive corporate officers to be “clawed back” under exceptional and serious circumstances. The clawback clause is designed as an effective means of aligning the interests of management with those of shareholders. It can be activated in the exceptional event that, in the two years following payment of the annual variable remuneration, the financial data on which it was based are found to have been demonstrably and intentionally distorted. The amount clawed back in this case would represent the sums impacted by the fraud.

2.4.1.2.B LONG-TERM REMUNERATION COMPONENTS

Performance share awards

With the exception of Arnaud Lagardère, executive corporate officers are awarded performance shares on a yearly basis. These awards are decided in the first half of the year, after publication of the Group’s results for the previous year. Their terms and conditions are set by the Appointments, Remuneration and CSR Committee in compliance with the recommendations of the Afep- Medef Code. The terms and conditions in force are described below.

Number of performance shares awarded:

- the value of the performance share rights awarded each year to each executive corporate officer may not exceed one-third of that officer’s total remuneration for the previous year;

- the overall number of performance share rights awarded to all executive corporate officers may not represent more than 20% of the total free share awards authorised by the shareholders;

- furthermore, pursuant to the authorisation given by the Company’s shareholders, the performance shares awarded yearly to each executive corporate officer may not exceed 0.025% of the number of shares comprising the Company’s share capital. This cap has not been revised since 2009.

Holding period for vested performance shares:

- 100% of the vested shares must be held in a registered account (nominatif pur) for a period of two years, although there is no legal obligation to do so. At the end of this two-year period;

- 25% of the vested shares must be held in a registered account (nominatif pur) until the beneficiary ceases his duties as an executive corporate officer;

- 25% of the vested shares must be held in a registered account (nominatif pur) until the value of the Lagardère SCA shares held equals at least one year’s worth of the executive corporate officer’s gross variable remuneration. This value is assessed each year based on (i) the average Lagardère SCA share price for the month of December of the previous year and (ii) the fixed and variable remuneration due in respect of the past year, with the theoretical maximum level being used for the variable portion;

- each executive corporate officer formally agrees not to enter into transactions to hedge risks associated with their performance shares during the holding period;

- at the close of the mandatory holding periods, the corresponding shares become transferable and can be traded under the terms and conditions established by law and regulations and in accordance with the black-out periods established by Lagardère SCA in its Confidentiality and Market Ethics Charter.

Vesting conditions:

- Performance conditions

The performance conditions are based on criteria representing key indicators used for the Group’s strategy, which ensure that the beneficiaries’ interests are closely aligned with those of the Company and its stakeholders.

One criterion has been modified compared to the previous remuneration policy in order to reflect (i) the impact of the Covid-19 crisis on the Group’s traditional performance indicators, and (ii) the new strategic roadmap adapted to take into account the impacts of this crisis as approved in 2020. The weighting applicable to nonfinancial criteria has also been increased, from 20% to 30%.

The criteria are all quantitative criteria and are assessed over a minimum period of three consecutive fiscal years, including the fiscal year during which the performance shares are awarded (the “reference period”). - For 25% of the performance shares awarded: the achievement during the reference period of a pre-defined return on capital employed (ROCE).

ROCE is a relevant performance indicator reflecting the profitability of the return on the Company’s operating assets and its ability to create value. - For 25% of the performance shares awarded: the achievement during the reference period of a pre-defined cumulative amount of free cash flow.

This criterion, which reflects the Group’s capacity to finance its investments and pay dividends, is also a key indicator of the Group’s financial health.

For each of these two objectives, the Managing Partners, further to the approval of the Appointments, Remuneration and CSR Committee and the Supervisory Board, validate the following:- the “target level” to be reached for 100% of the shares allocated to the objective to vest;

- the “trigger level”, corresponding to the level (i) above which 0% to 100% of the shares allocated to the objective will vest (determined on a straight-line basis) and (ii) below which no shares will vest. The trigger level cannot be lower than 66% of the target level.

- For 20% of the performance shares awarded: the comparative positioning of Lagardère SCA’s Total Shareholder Return (TSR) during the reference period, measured as follows:

- for 10% of the shares awarded, measured against the TSR of a panel of peer companies; and

- for 10% of the shares awarded, measured against the TSR of the other companies in the CAC Mid 60 index.

TSR incorporates both changes in share price and dividends paid, and therefore reflects the value delivered to shareholders as compared with the value created by other investments available to them. Consequently, TSR is also a key performance indicator for the Group.

For each of the 10% portions: - 50% of the shares awarded vest if Lagardère SCA’s average annual TSR during the reference period is at least equal to the average annual TSR of the reference panel;

- 100% of the shares awarded vest if Lagardère SCA’s average annual TSR during the reference period is at least 2% above the average annual TSR of the reference panel;

- between 50% and 100% of the shares awarded vest on a straight-line basis if Lagardère SCA’s average annual TSR during the reference period is between the average annual TSR of the reference panel and 2% above the reference panel’s average annual TSR;

- 0% of the shares awarded vest if Lagardère SCA’s average annual TSR during the reference period is below the average annual TSR of the reference panel.

- For 30% of the performance shares awarded: the achievement of precise objectives based on three quantitative criteria related to the Group’s key commitments under its Corporate Social Responsibility policy, each weighted equally (i.e., 10% for each criterion). This objective can for example concern gender equality, a reduction of the environmental impact of the Group’s activities, employee working conditions, or overall non-financial performance. As is the case for the variable portion of the annual remuneration, both the criteria themselves and the target and trigger levels set for each criterion are approved by the Managing Partners on the basis of proposals put forward by the Sustainable Development and CSR Department as endorsed by the Appointments, Remuneration and CSR Committee and the Supervisory Board.

The criteria used must be relevant to the Group’s CSR roadmap, measurable and monitored over time using reliable systems, and subject to verifications by the independent third party.

For each of the 10% portions:- 100% of the shares awarded vest if the target level is achieved;

- 0% of the shares vest if the trigger level is not achieved;

- between 0% and 100% of the shares vest on a straight-line basis if the achievement is between the trigger level and the target level.

For each annual performance share plan, further to discussion by the Appointments, Remuneration and CSR Committee and the Supervisory Board, the Managing Partners set all of the precise performance conditions and levels, in accordance with the principles described above. The performance objectives set must be demanding and consistent, both in terms of the Group’s historic performance and changes in its operating environment, notably in connection with its strategic refocusing.

- Presence condition

In order for the performance shares to vest, the executive corporate officer concerned must still be an executive corporate officer of Lagardère SCA three years after the award date.

In respect of this presence condition, rights to performance shares are:- forfeited if the executive corporate officer resigns, is dismissed or removed from office due to misconduct before the end of this three-year period;

- retained in full in the event his office is terminated ahead of term due to death or incapacity before the end of this three year period;

- retained in part on a pro rata basis if the executive corporate officer retires or is dismissed or removed from office for reasons other than misconduct before the end of this threeyear period.

Note that the performance conditions continue to apply in any event. The rights to free shares are partly retained on a pro rata basis in the specific cases of retirement or forced departure for reasons other than misconduct, because they are an essential component of the executive corporate officer’s annual remuneration and are awarded in consideration for duties performed in the year that the rights are awarded. The partial retention of these rights, which continue to be subject to achieving demanding long-term performance conditions, encourages the executive corporate officer to act in the long-term interests of the Group.

Consequently, all of the terms and conditions of the Company’s performance share awards fully comply with the recommendations in the Afep-Medef Code. This is the case for (i) the applicable performance conditions, which are solely based on quantitative criteria and combine internal and comparative criteria, and financial and non financial criteria, all corresponding to key indicators for the Company’s strategy, and (ii) the other terms and conditions (number of shares, vesting period, holding period etc.). All of these terms and conditions combined ensure that the performance share awards are a way of retaining the beneficiaries concerned and closely aligning their interests with those of the Company and its stakeholders.

2.4.1.2.C OTHER BENEFITS

A) Benefits in kind – business expenses

The executive corporate officers are provided with a company car, the potential personal use of which corresponds to a benefit in kind. The executive corporate officers are also entitled to the reimbursement of business travel and business entertainment expenses incurred in connection with their executive duties.

B) Supplementary pension plan

A supplementary pension plan was set up by Lagardère Capital & Management on 1 July 2005 for executive corporate officers. This is a defined supplementary benefit plan as provided for in article L. 137-11 of the French Social Security Code (Code de la sécurité sociale) and article 39 of the French Tax Code (Code général des impôts).

In accordance with French Government Order no. 2019-697 dated 3 July 2019, which reformed the statutory supplementary pension plan regime in France, this plan was closed to new entrants as from 4 July 2019, and benefits accrued under the plan were frozen as at 31 December 2019. No further benefits will be accrued under the plan as from that date.

The characteristics of this supplementary pension plan fully comply with the recommendations of the Afep-Medef Code.

Only employees or senior executives of Lagardère Capital & Management who were members of the Executive Committee were eligible for this plan.

The plan is a conditional benefit plan, and the pension will only be payable if the beneficiary is still with the company at retirement age, except in the event of (i) termination (other than for serious misconduct) after the age of 55 providing the beneficiary does not take up another post, (ii) long-term disability, and (iii) early retirement.

In addition, beneficiaries are required to have been members of the Executive Committee for at least five years at the date that they retire.

In the event of the beneficiary’s death, 60% of the pension is transferable to the surviving spouse.

Before the plan was frozen at 31 December 2019, its beneficiaries accrued supplementary pension entitlements at a rate equal to 1.75% of the benchmark remuneration per year of membership of the plan.

The benchmark remuneration corresponded to the average gross annual remuneration over the last five years (fixed + variable up to a maximum of 100% of the fixed portion). In addition, each annual remuneration could not exceed 50 times the annual limit defined by the French social security system i.e., a maximum amount of €2,026,200 in 2019. Each beneficiary’s benchmark remuneration was frozen at 31 December 2019.

As the number of years of plan membership used to calculate the benefit entitlements is capped at 20, the supplementary pension could not exceed 35% of the benchmark remuneration.

The pension entitlements are fully borne by the Company and this benefit is taken into account in determining the overall remuneration of executive corporate officers.

Under current social security laws (article L. 137-11 of the French Commercial Code), the Company is required to pay a contribution equal to 32% of the amount of the benefits, at the time that such benefits are paid.

In addition to the tax and social security contributions applicable to pensions (levied at a rate of 10.1%, of which 5.9% is tax-deductible), under current tax and social security laws, the annuities that will be paid to the beneficiaries will also be subject to the specific contribution provided for in article L. 137-11-1 of the French Social Security Code, before income tax withheld at source and any surtaxes on high incomes.

In 2021, a new supplementary “vested benefits” pension plan is to be set up in accordance with the new legal framework introduced by article L. 137-11-2 of the French Social Security Code.

This will be an individual rather than collective plan and will be “portable”, in that the benefits will be attached to the employee and will be carried over even in case of a change of employer.

The terms and conditions of this new pension plan, which will be available to members of the Executive Committee, will in any event comply with the applicable legislation.

Under this plan, the supplementary pension benefits will vest at a rate of 1.25% of the benchmark remuneration each year.

The benchmark remuneration corresponds to the gross annual remuneration (fixed + variable) and cannot exceed 50 times the annual ceiling used to calculate social security contributions.

Since the maximum vesting period is 20 years, the accumulated rights are capped at 25%.

In the event of the beneficiary’s death, 60% of the pension will be transferable to the surviving spouse.

In accordance with applicable legislation, vesting is subject to performance conditions and will require an achievement rate of at least 75% for the annual financial and non-financial targets used to determine the beneficiary’s annual variable remuneration.

In accordance with the provisions of the instruction of 23 December 2020, this new plan would apply with retroactive effect from 1 January 2020 and exceptionally, the performance conditions will not apply to rights in respect of the 2020 fiscal year.

C) Termination benefit

The Company has not given any commitments to the executive corporate officers in relation to granting them any termination benefits.

However, as they are employees of Lagardère Management, the executive corporate officers (with the exception of Arnaud Lagardère) may be eligible for benefits in certain cases of contract termination, pursuant to the applicable laws, regulations and collective bargaining agreements.

In all circumstances, any benefits paid to the executive corporate officers may not exceed the cap of two years’ worth of fixed and variable remuneration recommended in the Afep-Medef Corporate Governance Code.

D) Extraordinary remuneration

Bonuses may be granted to the executive corporate officers in very specific and exceptional circumstances, notably in connection with one-off transactions requiring extensive involvement of the executive corporate officers, particularly when the impacts of such transactions, despite being extremely significant for the Group, cannot be taken into account in determining the variable portion of their remuneration.

The conditions of any exceptional bonus awards and payments are determined in accordance with best corporate governance practices. Any exceptional bonus award, which must be disclosed and justified in detail, may not in any case exceed 150% of the annual fixed remuneration of the executive corporate officer concerned.

Over the past six years, the executive corporate officers (with the exception of Arnaud Lagardère) have only once been awarded a special bonus: in 2014, when the Group sold its stake in EADS and Canal+ France. The total amount of the bonuses paid to the Co-Managing Partners represented 0.1% of the proceeds from these divestments, of which 58% was paid over to shareholders and on average, represented 85.68% of the annual fixed remuneration of the Co-Managing Partners.

2.4.1.2.D SUMMARY PRESENTATION OF THE REMUNERATION STRUCTURE

As described above, the annual remuneration of the Company’s executive corporate officers is structured in compliance with best corporate governance practices. The principles underlying this structure are straightforward, stable and transparent, and they ensure that the interests of the executives are closely aligned with the interests of the Company and its stakeholders.

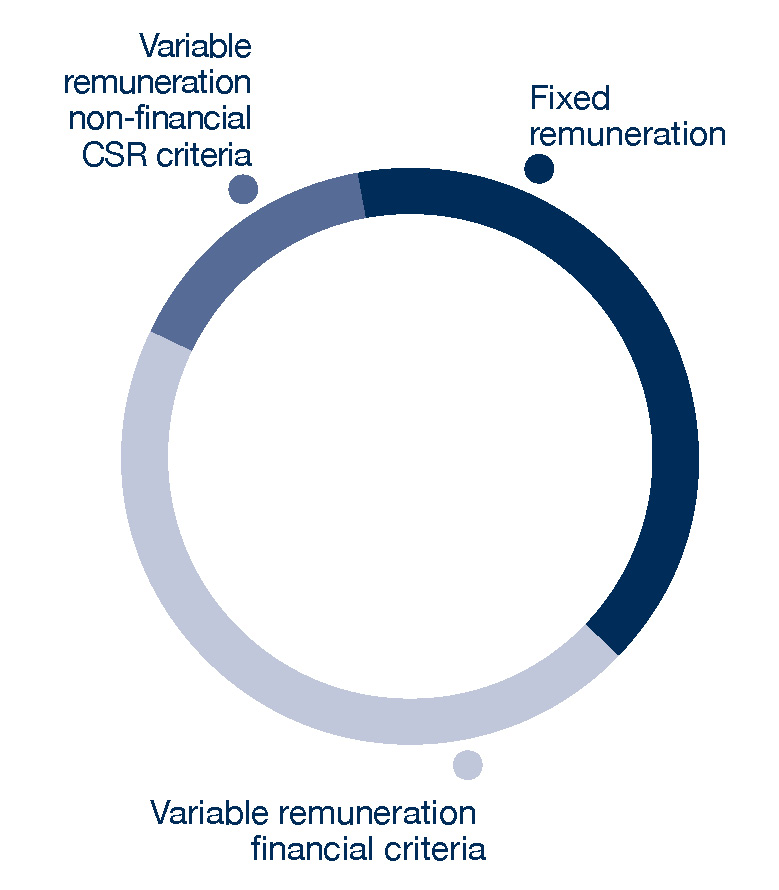

Arnaud Lagardère

Arnaud Lagardère’s annual remuneration mainly comprises (i) fixed remuneration and (ii) variable cash remuneration that may not exceed 150% of his fixed remuneration. His variable remuneration is based on:

- quantitative financial criteria (75% weighting);

- quantitative non-financial CSR criteria (25% weighting).

As Arnaud Lagardère is a significant shareholder of Lagardère SCA, owning 7.26% of its capital and 11.03% of the voting rights, he is naturally exposed to the Company’s share performance and therefore does not receive any free share awards or share options.

Arnaud Lagardère

- Variable remuneration non-financial CSR criteria

- Fixed remuneration

- Variable remuneration financial criteria

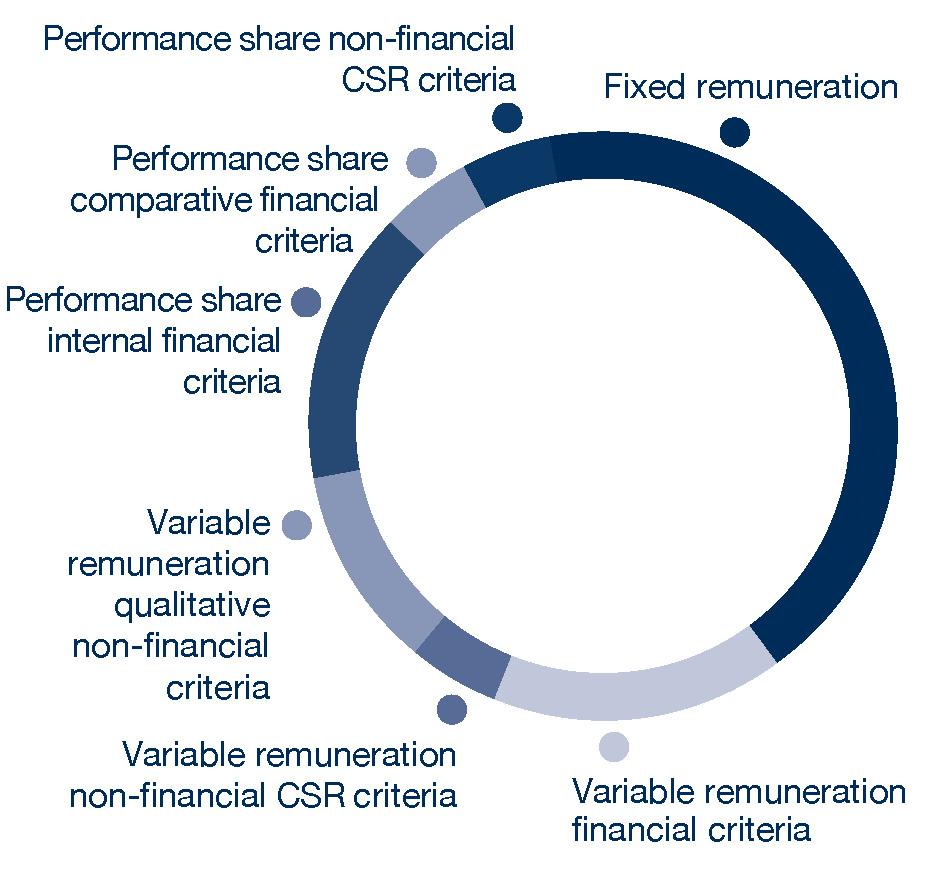

Pierre Leroy and Thierry Funck-Brentano

The annual remuneration of the other executive corporate officers mainly comprises (i) fixed remuneration, (ii) variable cash remuneration, and (iii) performance share awards.

Their variable cash remuneration – which may not exceed 75% of their fixed remuneration – is based on:

- quantitative financial criteria (50% weighting);

- quantitative non-financial CSR criteria (25% weighting);

- qualitative criteria (25% weighting), it being specified that this qualitative variable portion may not exceed 25% of their fixed remuneration.

Performance share awards may not represent more than 33.33% of the overall remuneration (fixed and variable) of the executive corporate officers concerned, and the vesting of the shares is contingent on long-term performance (over three consecutive fiscal years). The applicable performance criteria – which are solely quantitative – correspond to:

- internal financial criteria (50% weighting);

- comparative financial criteria (20% weighting);

- non-financial CSR criteria (30% weighting).

Pierre Leroy and Thierry Funck-Brentano

- Fixed remuneration

- Variable remuneration financial criteria

- Variable remuneration non-financial CSR criteria

- Variable remuneration qualitative non-financial criteria

- Performance share internal financial criteria

- Performance share comparative financial criteria

- Performance share non-financial CSR criteria

2.4.2 TOTAL REMUNERATION AND BENEFITS PAID DURING OR ALLOCATED IN RESPECT OF 2020 TO THE EXECUTIVE CORPORATE OFFICERS

This section notably includes, with regard to the executive corporate officers, the information referred to in article L. 22-10-9 of the French Commercial Code

2.4.2.1 COMPONENTS OF REMUNERATION PAID OR ALLOCATED

A) ANNUAL FIXED REMUNERATION

The remuneration policy approved for 2020 had maintained executive corporate officers’ fixed remuneration amounts unchanged for the past ten years, i.e., at €1,140,729 for Arnaud Lagardère, €1,474,000 for Pierre Leroy and €1,206,000 for Thierry Funck-Brentano.

In the context of the Covid-19 crisis, the executive corporate officers, like the other members of the Executive Committee, voluntarily decided to reduce their fixed remuneration by 20% for April and May 2020, and to set aside the amounts to the Covid-19 Solidarity Fund created by the Company for its employees, temporary staff and partners.

Consequently:

Arnaud Lagardère received €1,102,705 in annual fixed remuneration;

Pierre Leroy received €1,424,867 in annual fixed remuneration;

Thierry Funck-Brentano received €1,165,800 in annual fixed remuneration.

B) ANNUAL VARIABLE REMUNERATION

Annual variable remuneration paid during 2020

As annual variable remuneration for a given year can only be calculated after the end of that year and is submitted for shareholders’ approval as part of the ex-post “say on pay” vote (article L. 22-10-77, II of the French Commercial Code), it is only paid during the following year.

Consequently, the variable remuneration due to the executive corporate officers in respect of 2019 was only paid in 2020, following approval of the shareholders at the General Meeting of 5 May 2020 (under the tenth, eleventh and twelfth resolutions, each approved by 72.48% of the votes).

The amounts of variable remuneration allocated in respect of 2019 and paid in 2020 were as follows:

- For Arnaud Lagardère: €1,569,750;

- For Pierre Leroy and Thierry Funck-Brentano: €698,500.

Annual variable compensation allocated in respect of 2020

Quantitative portion of annual variable compensation.

Financial criteria

For 2020, executive corporate officers’ annual variable remuneration was based on two financial criteria: (i) recurring operating profit of fully consolidated companies (recurring EBIT), and (ii) net cash from operating activities of fully consolidated companies, applied to a benchmark amount of €1,050,000 for Arnaud Lagardère and €300,000 for Pierre Leroy and Thierry Funck-Brentano.

The benchmark amounts are then multiplied by a factor equal to the arithmetic average of the following two inputs:

- the differential between the growth rate in recurring operating profit of fully consolidated companies communicated as market guidance at the beginning of the year and the growth rate in said recurring operating profit actually attained (applied on a proportional basis in the event of a negative change and at a rate of 10% per percentage point in the event of a positive change);

- the percentage difference between the amount of net cash from operating activities of fully consolidated companies as forecast in the Group’s provisional consolidated budget and the amount of net cash from operating activities of fully consolidated companies actually attained (applied on a proportional basis).

The arithmetic average of these two inputs may be impacted (downwards only) if there is a negative change in recurring operating profit of fully consolidated companies, as compared with the previous year, by directly applying the negative change percentage.

On 27 February 2020, at the time of publishing its 2019 annual results, the Company’s guidance was an increase in recurring operating profit of fully consolidated companies (recurring EBIT) of between 4% and 6% at constant exchange rates, excluding the acquisition of International Duty Free and excluding the impact of the coronavirus. On 25 March 2020, in view of the uncertainty over the duration and scale of the epidemic and government-imposed lockdowns and closures, the Company suspended this guidance, which it then cancelled on 5 November 2020.

The first provisional consolidated budget approved at the start of the year forecast a net cash inflow from operating activities of fully consolidated companies of €436.6 million. In light of the impacts of the Covid-19 pandemic, this amount was revised in July 2020 and reduced to a net cash outflow of €253.8 million. The actual net cash outflow from operating activities of fully consolidated companies amounted to €96.9 million for 2020, significantly better than the amount revised in mid-year.

Based on the criteria and targets set in February 2020 before the Covid-19 pandemic really began to hit and severely disrupt the Group’s operations and results, a factor of 0 was applied to the associated benchmark amounts (versus 1.12 in 2019 and 1.163 in 2018), leading to a variable financial portion equal to €0 for Arnaud Lagardère, Pierre Leroy and Thierry Funck-Brentano.

Non-financial CSR criteria

For 2020, the achievement levels for the non financial CSR criteria resulted in a factor of 1.125. Consequently, the variable portion of the executive corporate officers’ remuneration based on quantitative non-financial CSR criteria amounted to €393,750 for Arnaud Lagardère (€350,000 x 1.125) and €112,500 for Pierre Leroy and Thierry Funck-Brentano (€100,000 x 1.125).

| Criteria | Minimum performance level | Target performance level | Level achieved | Achievement rate |

| Proportion of female executive managers by end-2020 | 42 % | 44 % | 51 % | 1.50 |

| Scopes 1 & 2 CO2 emissions per million euros of revenue in 2019 (tCO2 eq) | 16.2 | 14.6 | 18.1 | 0 |

| Proportion of Group employees having an employee representative at end-2019 | 67 % | 71 % | 73 % | 1.50 |

| Percentile ranking in the Dow Jones Sustainability Index | 81 % | 87 % | 93 % | 1.50 |

| Average | 1.125 |

- exceeding the target performance level corresponds to a 1.50 achievement rate;

- meeting the target performance level corresponds to a 1.25 achievement rate;

- not meeting the target performance level corresponds to a 0.75 achievement rate;

- not meeting the minimum performance level corresponds to a 0 achievement rate.

Pursuant to the remuneration policy, the criteria themselves and the minimum and target performance levels were approved on the basis of proposals put forward by the Sustainable Development and CSR Department.

The first three criteria were selected because they embody the focal areas of the Group’s CSR policy (social, environmental and societal issues).

They are reported on each year in the Group’s annual report, which ensures their transparency. The first three criteria also form part of the quantitative “information considered the most important”, which is subject to the specific procedures carried out by the independent third party in order to draw up its report on the Group’s consolidated non-financial statement.

The first criterion – concerning the proportion of female executive managers – is a key indicator for the Group’s performance in implementing its strategy of promoting diversity. It is a growth and creativity driver and has been one of the priority objectives of the Group’s CSR roadmap for many years. In addition, this criterion is fully in line with the general objective of gender diversity in senior management that is a central governance goal for modern-day companies. The target set was exceeded, with women representing 51% of the Group’s executives. In light of this, the Managing Partners decided to set a target covering a more restrictive scope of 300 top managers, effective as from 2021 (see section 2.7.4. – Executive body gender balance policy).

The second criterion – Scopes 1 & 2 CO2 emissions per million euros of revenue (tCO2 eq) – is a benchmark indicator for controlling the environmental impacts of operations, which represents an essential global objective for any company with a consistent CSR strategy. The criterion used covers Scope 1 and Scope 2 emissions, i.e., direct emissions from owned or controlled sources (from stationary combustion sources using gas and fuel oil for example) and indirect emissions from the generation of purchased energy (such as electricity and district heating), for all of the Group’s offices, points of sale, warehouses, live performance venues and other sites out of which it operates. These emissions correspond to elements over which the Group has real operational leverage and on which it therefore focuses as part of its CSR strategy. The trigger level of the target was not achieved for this criterion, which was affected by government-imposed lockdowns and closures that led to the full-scale shutdown of certain activities and a sharp decline in revenue, but no corresponding energy savings.

The third criterion – the proportion of Group employees with an employee representative – is a key indicator of the quality of the Group’s labour relations, which is an essential component of its CSR policy. It fits seamlessly with the clear principle of seeking a permanent balance between financial targets and HR goals.Through this employee representative system, the Group can build up a steady flow of constructive dialogue with its people, notably concerning working conditions, the goals and challenges of the Group, and the business transformations it needs to undertake. The target set was exceeded.

The final criterion – the Group’s percentile ranking in the Dow Jones Sustainability Index – is an external criterion that gives an overall evaluation of the Group’s CSR performance and a comparison against other companies included in the index. Through this criterion, the Group’s internal assessment based on specific criteria can be rounded out by an objective overall external evaluation performed by a recognised expert in the sector, which also gives an insight into how the Group’s stakeholders view its CSR approach. Additionally, in the same way as the first three criteria, it provides transparency and ensures that the Group’s performance can be tracked over the long term. The target set for this criterion was also exceeded, as the Company’s percentile ranking rose from 87% in 2019 to 93% in 2020.

For each of the four criteria, the minimum and target performance levels have been set in such a way as to create demanding and consistent objectives that factor in (i) the Group’s historic performance over the previous three years and (ii) changes in its operating environment, notably in connection with its strategic refocusing. These criteria and targets were also set at the start of the year before the Covid-19 pandemic really began to hit.

Qualitative portion of annual variable compensation

In light of the achievements described below, Arnaud Lagardère deemed that the targets set for 2020 had largely been met with strong personal input from the executive corporate officers in the unprecedented context of the Covid-19 crisis.

Based on this assessment, Arnaud Lagardère decided to apply a factor of 1.25 (identical to 2020 and 2019). Consequently, the variable portion of Pierre Leroy and Thierry Funck-Brentano’s remuneration based on qualitative criteria amounted to €250,000 (€200,000 x 1.25) each.

Execution of the Group’s strategic plan

2020 saw the completion of the Group’s strategic plan to refocus its business, with the disposals of Lagardère Sports to H.I.G Capital in April and of Lagardère Studios to Mediawan on 30 October 2020.

The year was also defined by the devastating Covid-19 crisis. From the outset, the Managing Partners, working closely alongside the divisional managers, assessed the impact of the pandemic on the dynamics of the Group’s different markets. The aim was to draw up a new strategic roadmap that would enable (i) Lagardère Travel Retail to emerge stronger from the crisis thanks to the implementation of an ambitious operational performance plan, (ii) Lagardère Publishing to strengthen its positions in order to confirm its power engine status, and (iii) the Group’s other activities to enhance their value.

In view of the uncertainty surrounding the ongoing health crisis, the Managing Partners also bolstered the Group’s financial structure by arranging a state-backed loan for €465 million, and amending and extending the term of its revolving credit facility. Against this backdrop, its covenants were redefined to take account of the impacts of the health crisis on all of the Group’s businesses.

Quality of governance and management

In the unprecedented context of the Covid-19 pandemic, the Managing Partners rapidly implemented a comprehensive action plan to address the crisis, with the overriding objective of protecting the Group’s employees, customers and partners.

In terms of compliance, the Managing Partners focused particularly on (i) fighting corruption with the launch of the ethics whistleblowing line, (ii) international economic sanctions with ongoing awarenessraising sessions for the employees most exposed to such risks, and (iii) personal data protection with the design of a pedagogical Compliance Pack for all its employees.

Summary of variable remuneration allocated in respect of 2020

The application of the quantitative and qualitative criteria described above led to the allocation of the following variable remuneration in respect of 2020, which will be paid in 2021 provided it is approved at the Annual General Meeting to be held on 30 June 2021.

| Weighting (% of benchmark amount) | Benchmark amount (in euros) | Maximum amount (% of fixed remuneration) | Achievement rate applied to the benchmark amount | Variable remuneration | ||

| Amount to b paid (in euros) | (% of fixed remuneration) | |||||

| Arnaud Lagardère | ||||||

| Quantitative financial criteria | 75 % | 1,050,000 | 150 % | 0 | 0 | 0 % |

| Quantitative non-financial CSR criteria | 25 % | 350,000 | 1,125 | 393,750 | 34.52 % | |

| Qualitative criteria | N/A | N/A | N/A | N/A | N/A | N/A |

| Total | 100 % | 1,400,000 | 150 % | 393,750 | 34.52 % | |

| Pierre Leroy | ||||||

| Quantitative financial criteria | 50 % | 300,000 | 0 | 0 | 0 % | |

| Quantitative non-financial CSR criteria | 16.67 % | 100,000 | 1.125 | 112,500 | 7.63 % | |

| Qualitative criteria | 33.33 % | 200,000 | 25 % | 1.25 | 250,000 | 16.96 % |

| Total | 100 % | 600,000 | 75 % | 362,500 | 24.59 % | |

| Thierry Funck-Brentano | ||||||

| Quantitative financial criteria | 50 % | 300,000 | 0 | 0 | 0 % | |

| Quantitative non-financial CSR criteria | 16.67 % | 100,000 | 1.125 | 112,500 | 9.33 % | |

| Qualitative criteria | 33.33 % | 200,000 | 25 % | 1.25 | 250,000 | 20.73 % |

| Total | 100 % | 600,000 | 75 % | 362,500 | 30.06 % | |

C) PERFORMANCE SHARE AWARDS

The remuneration policy approved for 2020 included the award of performance shares to the Co-Managing Partners, Pierre Leroy and Thierry Funck-Brentano, in proportions that complied with the rules set out in the 2021 remuneration policy described above, which remains unchanged in this respect.

In the unprecedented context of the Covid-19 pandemic, the Managing Partners decided not to award any performance shares in 2020. Accordingly, the two Co-Managing Partners did not receive any performance shares during the year.

D) BENEFITS IN KIND – BUSINESS EXPENSES

In accordance with the remuneration policy, the executive corporate officers each had the use of a company car in 2020.

The value of this benefit-in-kind is based on the executive corporate officers’ potential personal use of their car, and corresponds to the following amounts:

- For Arnaud Lagardère: €18,616;

- For Pierre Leroy: €16,281;

- For Thierry Funck-Brentano: €13,644.

E) SUPPLEMENTARY PENSION PLAN

In accordance with French Government Order no. 2019-697 dated 3 July 2019, which reformed the statutory supplementary conditional benefit pension plan in France governed by article L. 137-11 of the French Social Security Code, the plan available to the executive corporate officers was closed to new entrants as from 4 July 2019, and benefits accrued under the plan along with the officers’ benchmark remuneration were frozen as at 31 December 2019.

No amounts were paid to the executive corporate officers under this plan in 2020. At 31 December 2020, the estimated amounts of the future pension annuities were €686,490 for Arnaud Lagardère and Pierre Leroy, and €669,144 for Thierry Funck-Brentano.

F) EXTRAORDINARY REMUNERATION

The executive corporate officers did not receive any extraordinary remuneration for 2020.

2.4.2.2 SUMMARY TABLES

The information and tables provided in this section show the remuneration of the Company’s executive corporate officers based on the presentation format recommended in the Afep-Medef Code and AMF recommendation 2021-02.

Arnaud Lagardère

| Summary of gross remuneration and benefits (before deducting social security contributions) | |||||

| Fiscal year 2019 | Fiscal year 2020 | ||||

| Amounts allocated | Amounts paid | Amounts allocated | Amounts paid | ||

| Fixed remuneration | 1,140,729 | 1,140,729 | 1,140,729 (1) | 1,102,705 (1) | |

| Variable remuneration | 1,569,750 (2) | 1,628,200 (2) | 393,750 (2) | 1,569,750 (2) | |

| Extraordinary remuneration | - | - | - | - | |

| Remuneration allocated for offices held | - | - | - | - | |

| Benefits in kind | 18,616 | 18,616 | 18,616 | 18,616 | |

| ________________ | _______________ | ________________ | _______________ | ||

| Total | 2,729,095 | 2,787,545 | 1,553,095 | 2,691,071 | |

(1) Members of the Executive Committee decided to reduce their fixed remuneration for April and May 2020 by 20%.

(2) As the variable portion of annual remuneration for a given year can only be calculated after the end of that year, it is paid during the following year.

Arnaud Lagardère, who is a significant shareholder of the Company, has not been awarded any share options or free shares since his appointment as General and Managing Partner in 2003.

- Share options granted during the year: none.

- Share options exercised during the year: none.

- Performance share rights granted during the year: none.

- Performance shares that became available during the year: none

| Total remuneration and benefits, share options and performance shares granted | |||||

Fiscal year 2019 |

Fiscal year 2020 | ||||

| Remuneration allocated for the year (details in previous table) | 2,729,095 | 1,553,095 | |||

| Value of multi-annual variable remuneration allocated during the year | None | None | |||

| Value of share options granted during the year | None | None | |||

| Value of performance share rights granted during the year | None | None | |||

| Total | 2,729,095 | 1,553,095 | |||

Pierre Leroy

| Summary of gross remuneration and benefits (before deducting social security contributions) | |||||

| Fiscal year 2019 | Fiscal year 2020 | ||||

| Amounts allocated | Amounts paid | Amounts allocated | Amounts paid | ||

| Fixed remuneration | 1,474,000 | 1,474,000 | 1,474,000 (1) | 1,424,867 (1) | |

| Variable remuneration | 698,500 (2) | 723,900 (2) | 362,500 (2) | 698,500 (2) | |

| Extraordinary remuneration | - | - | - | - | |

| Remuneration allocated for offices held | - | - | - | - | |

| Benefits in kind | 16,281 | 16,281 | 16,281 | 16,281 | |

| ________________ | _______________ | ________________ | ________________ | ||

| Total | 2,188 781 | 2,214,181 | 1,852,781 | 2,139,648 | |

(1) Members of the Executive Committee decided to reduce their fixed remuneration for April and May 2020 by 20%.

(2) As the variable portion of annual remuneration for a given year can only be calculated after the end of that year, it is paid during the following year.

- Share options granted during the year: none.

- Share options exercised during the year: none.

- Performance share rights granted during the year: none.

- Performance shares that became available during the year: 16,000.

The mandatory holding period for the 32,000 performance shares which vested for Pierre Leroy on 1 April 2018 under the 1 April 2015 plan ended on 1 April 2020. According to the holding rules defined by the Supervisory Board in accordance with the applicable laws and with the recommendations of the Afep-Medef Corporate Governance Code, half of these shares are still subject to holding periods based on the valuation of Pierre Leroy’s share portfolio and the termination of his duties.

- Performance shares that vested during the year: 5,856.

Of the 32,000 performance shares granted to Pierre Leroy under the 6 April 2017 plan, 5,856 shares (i.e., 18.3%) vested on 7 April 2020, resulting from the application of the performance conditions provided for in the decision to award the shares.

Achievement of the objective relating to growth in Group recurring operating profit:

- average annual growth rate for Group recurring operating profit between 2017 and 2019: (6.74% + 2.14% + 5.63%)/3 = 4.84%;

- achievement rate of objective = 0% (below the trigger level of 7.36%).

Achievement of the objective relating to net cash from operating activities of fully consolidated companies:

- average annual amount of net cash from operating activities of fully consolidated companies between 2017 and 2019: (318 + 455 + 474) = €415.6 million;

- achievement rate of objective (415.6 - 349.5)/(529.6 - 349.5) = 36.7%.

| Total remuneration and benefits, share options and performance shares granted | |||||

| Fiscal year 2019 | Fiscal year 2020 | ||||

| Remuneration awarded for the year (see previous table) | 2,188,781 | 1,852,781 | |||

| Value of multi-annual variable remuneration awarded for the year | None | None | |||

| Value of share options granted during the year | None | None | |||

| Value of rights to performance shares awarded during the year | 524,480 | 0 | |||

| Total | 2,713,261 | 1,852,781 | |||

Thierry Funck-Brentano

| Summary of gross remuneration and benefits (before deducting social security contributions) | |||||

| Fiscal year 2019 | Fiscal year 2020 | ||||

| Amounts allocated | Amounts paid | Amounts allocated | Amounts paid | ||

| Fixed remuneration | 1,206,000 | 1,206,000 | 1,206,000 (1) | 1,165,800 (1) | |

| Variable remuneration | 698,500 (2) | 723,900 (2) | 362,500 (2) | 698,500 (2) | |

| Extraordinary remuneration | - | - | - | - | |

| Remuneration allocated for offices held | - | - | - | - | |

| Benefits in kind | 13,644 | 13,644 | 13,644 | 13,644 | |

| ________________ | _______________ | ________________ | ________________ | ||

| Total | 1,918,144 | 1,943,544 | 1,582,144 | 1,877,944 | |

(1) Members of the Executive Committee decided to reduce their fixed remuneration for April and May 2020 by 20%.

(2) As the variable portion of annual remuneration for a given year can only be calculated after the end of that year, it is paid during the following year.

- Share options granted during the year: none.

- Share options exercised during the year: none.

- Performance share rights granted during the year: none.

- Performance shares that became available during the year: 24,000.

The mandatory holding period for the 32,000 performance shares which vested for Thierry Funck-Brentano on 1 April 2018 under the 1 April 2015 plan ended on 1 April 2020. According to the holding rules defined by the Supervisory Board in accordance with the applicable laws, a quarter of these shares are still subject to a holding period until the termination of Thierry Funck-Brentano’s duties. Since the valuation of Thierry Funck-Brentano’s share portfolio is higher than one year of his fixed and variable remuneration, the holding period established in accordance with the recommendations of the Afep-Medef Corporate Governance Code and applicable to a quarter of the shares, no longer applies.

- Performance shares that vested during the year: 5,856.

Of the 32,000 performance share sgrantedto Thierry Funck-Brentano under the 6 April 2017 plan, 5,856 shares (i.e., 18.3% of the total shares granted) vested on 7 April 2020, resulting from the application of performance conditions provided for in the decision to award the shares:

Achievement of the objective relating to growth in Group recurring operating profit:

- average annual growth rate for Group recurring operating profit between 2017 and 2019: (6.74% + 2.14% + 5.63%)/3 = +4.84%;

- achievement rate of objective = 0% (below the trigger level of 7.36%).

Achievement of the objective relating to net cash from operating activities of fully consolidated companies:

- average annual amount of net cash from operating activities of fully consolidated companies between 2017 and 2019: (318 + 455 + 474) = €415.6 million;

- achievement rate of objective (415.6 - 349.5)/ (529.6 - 349.5) = 36.7%.

| Total remuneration and benefits, share options and performance shares granted | |||||

| Fiscal year 2019 | Fiscal year 2020 | ||||

| Remuneration allocated for the year (details in previous table) | 1,918,144 | 1,582,144 | |||

| Value of multi-annual variable remuneration allocated during the year | None | None | |||

| Value of share options granted during the year | None | None | |||

| Value of performance share rights granted during the year | 524,480 | None | |||

| Total | 2,442,624 | 1,582,144 | |||

Share options(1)

| Plans expired | |||||||

| 2001 Plan | 2002 Plan | 2003 Plan | 2004 Plan | 2005 Plan | 2006 Plan | ||

| Date of AGM | 23 May 2000 | 23 May 2000 and 13 May 2003 |

11 May 2004 | 2 May 2006 | |||

| Date of Board of Directors’ or Executive Board meeting< (as relevant) | Not relevant to Lagardère SCA, which is a French partnership limited by shares Grant date = date of decision by the Managing Partners |

||||||

| Total number of share under option(1) | 1,271,740(*) | 1,313,639(*) | 1,453,451(*) | 1,577,677(***) | 1,736,769(**) | 1,919,029(**) | |

| O/w shares available for subscription or purchase by Managing Partners and members of the Supervisory Board(1) : | |||||||

| Arnaud Lagardère | 50,560 | 50,554 | 0 | 0 | 0 | 0 | |

| Pierre Leroy | 30,336 | 30,333 | 40,444 | 50,433 | 62,345 | 62,350 | |

| Philippe Camus | 20,224 | 20,222 | 30,333 | 30,336 | 50,000 | 50,000 | |

| Dominique D'Hinnin | 30,336 | 30,333 | 40,444 | 50,433 | 62,345 | 62,350 | |

| Thierry Funck-Brentano | 30,336 | 30,333 | 40,444 | 50,433 | 62,345 | 62,350 | |

| Start of exercise period | 19 Dec. 2003 | 19 Dec. 2004 | 18 Dec. 2005 | 20 Nov. 2006 | 21 Nov. 2007 | 14 Dec. 2008 | |

| Option expiry date | 19 Dec. 2008 | 19 Dec. 2009 | 18 Dec. 2013 | 20 Nov. 2014 | 21 Nov. 2015 | 14 Dec. 2016 | |

| Subscription or purchase Price | €46.48(*) | €51.45(*) | 51.45(*) | €41.64(***) | €45.69(**) | €44.78(**) | |

| Number of shares vested at 28 February 2019 | 30 336 (2) | - | - | - | - | - | |

| Total number of share options cancelled or forfeited: | |||||||

| Arnaud Lagardère | 50,560 | 50,554 | - | - | - | - | |

| Pierre Leroy | 30,333 | 40,444 | 50,433 | 62,345 | 62,350 | ||

| Philippe Camus | 20,224 | 20,222 | 30,333 | 30,336 | 50,000 | 50,000 | |

| Dominique D'Hinnin | 30,336 | 30,333 | 40,444 | 50,433 | 62,345 | 62,350 | |

| Thierry Funck-Brentano | 30,336 | 30,333 | 40,444 | 50,433 | 62,345 | 62,350 | |

| Share options(1) outstanding at end-2018: | |||||||

| Arnaud Lagardère | 0 | 0 | - | - | - | - | |

| Pierre Leroy | 0 | 0 | 0 | 0 | 0 | 0 | |

| Dominique D'Hinnin | 0 | 0 | 0 | 0 | 0 | 0 | |

| Thierry Funck-Brentano | 0 | 0 | 0 | 0 | 0 | 0 | |

(1) Share purchase plans only.

(2) Exercised by Pierre Leroy on 20 December 2005.

(*) After adjustment on 6 July 2005.

(**) After adjustment on 20 June 2014.

(***) After adjustments on 6 July 2005 and 20 June 2014.

Historical information on performance share awards

| Plan 1 | Plan 2 | Plan 3 | Plan 4 | Plan 5 | Plan 6 | Plan 7 | Plan 8 | Plan 9 | Plan 10 | |

| Date of AGM | 28 April 2009 |

28 April 2009 |

28 April 2009 |

28 April 2009 |

3 May 2013 |

3 May 2013 |

3 May 2016 |

3 May 2016 |

3 May 2016 |

10 May 2019 |

| Date of grant(*) | 31 Dec. 2009 |

17 Dec. 2010 |

29 Dec. 2011 |

25 June 2012 |

26 Dec. 2013 |

1 April 2015 |

9 May 2016 |

6 April 2017 |

16 April 2018 |

14 May 2019 |

| Total number of free shares granted(**) |

50,000 | 116,000 | 104,000 | 115,017 | 115,017 | 96,000 | 64,000 | 64,000 | 64,000 | 64,000 |

| Of which granted to: | ||||||||||

| Arnaud Lagardère(***) | - | - | - | - | - | - | - | - | - | - |

| Pierre Leroy | 25,000 | 29,000 | 26,000 | 38,339 | 38,339 | 32,000 | 32,000 | 32,000 | 32,000 | 32,000 |

| Philippe Camus | 25,000 | 29,000 | 26,000 | - | - | - | - | - | - | - |

| Dominique D'Hinnin | - | 29,000 | 26,000 | 38,339 | 38,339 | 32,000 | - | - | - | - |

| Thierry Funck-Brentano | - | 29,000 | 26,000 | 38,339 | 38,339 | 32,000 | 32,000 | 32,000 | 32,000 | 32,000 |

| Vesting date | 2 April 2012 2 April 2014 |

2 April 2013 | 2 April 2014 | 1 April 2015 | 1 April 2017 | 1 April 2018 | 10 May 2019 | 7 April 2020 | 17 April 2021 | 15 May 2022 |

| End of holding period(****) | 2 April 2014 | 2 April 2015 | 2 April 2016 | 1 April 2017 | 1 April 2019 | 1 April 2020 | 10 May 2021 | 7 April 2022 | 17 April 2023 | 15 May 2024 |

| Performance conditions | yes | yes | yes | yes | yes | yes | yes | yes | yes | yes |

| Number of shares vested at 31 March 2021 |

42,310 | 59,547 | 72,054 | 104,253 | 111,036 | 96,000 | 47,180 | 11,712 | - | |

| Total number cancelled or forfeited |

7,690 | 56,453 | 31,946 | 10,764 | 3,981 | 0 | 16,820 | 52,288 | - | |

| Arnaud Lagardère | - | - | - | - | - | - | - | - | - | |

| Pierre Leroy | 3,845 | 9,151 | 1,982 | 3,588 | 1,327 | 0 | 8,410 | 26,144 | - | |

| Philippe Camus | 3,845 | 29,000 | 26,000 | - | - | - | - | - | - | |

| Dominique D'Hinnin | - | 9,151 | 1,982 | 3,588 | 1,327 | 0 | - | - | ||

| Thierry Funck-Brentano | - | 9,151 | 1,982 | 3,588 | 1,327 | 0 | 8,410 | 26,144 | - | |

| Performance shares outstanding at 2019(**) |

- | - | - | - | - | - | - | - | 64,000 | 64,000 |

| Arnaud Lagardère | - | - | - | - | - | - | - | - | - | - |

| Pierre Leroy | - | - | - | - | - | - | - | - | 32,000 | 32,000 |

| Philippe Camus | - | - | - | - | - | - | - | - | - | - |

| Dominique D'Hinnin | - | - | - | - | - | - | - | - | - | - |

| Thierry Funck-Brentano | - | - | - | - | - | - | - | - | 32,000 | 32,000 |

(*) Since Lagardère SCA is a French partnership limited by shares, performance share awards are the responsibility of the Managing Partners and are only coordinated by the Supervisory Board.

(**) After adjustment on 20 June 2014.

(***) Arnaud Lagardère, Managing Partner, does not receive any performance shares.

(****) Applicable to 50% of the vested shares. The shares corresponding to the remaining 50% are subject to additional holding conditions (see section 2.4.1.2.B above).

Other

| Executive corporate officers | Employment contract(1) |

Supplementary pension plan |

Indemnities or benefits receivable or likely to be receivable due to a termination or change of function |

Indemnities receivable under a non-competition clause |

||||||

| Arnaud Lagardère Position: Managing Partner Date of appointment:End of term of office: |

Renewed 17 August 2020 for a four year term |

X | X (2) | X | X | |||||

| } | ||||||||||

| Pierre Leroy Position: Managing Partner(a) Date of appointment: End of term of office: |

N.A. (1) | X(2) | X(3) | X | ||||||

| Thierry Funck-Brentano Position: Managing Partner(b) Date of appointment: End of term of office: |

N.A. (1) | X(2) | X(3) | X | ||||||

(a) Deputy Chairman and Chief Operating Officer of Arjil Commanditée-Arco whose term of office as Managing Partner of Lagardère SCA was renewed on 9 March 2016 for a six-year period.

(b) Chief Operating Officer of Arjil Commanditée-Arco, appointed in that capacity on 10 March 2010 for a six-year period and on 9 March 2016 for a further six-year period.

(1) The Afep-Medef Corporate Governance Code recommendations that company officers should not hold employment contracts with the company only apply to the following persons: Chairman of the Board of Directors, Chairman and Chief Executive Officer, Chief Executive Officer of companies with a Board of Directors, Chairman of the Management Board, Chief Executive Officer of companies with a Management Board and Supervisory Board, and Managing Partners of French partnerships limited by shares (SCA).

(2) See section 2.4.1.2.C B) above.

(3) See section 2.4.1.2.C C) above.

PAY RATIOS

French Government Order 2019-1234 of 27 November 2019 introduced the requirement for companies to disclose, in their corporate governance reports, the following information for each executive corporate officer:

- the ratios between (i) the remuneration of the officer and (ii) the average and median remuneration, on a full-time equivalent basis, of the Company’s non-executive employees;

- year-on-year changes in remuneration; the Company’s performance; the average remuneration, on a full-time equivalent basis, of the Company’s employees; and the above ratios, covering at least the past five years.

In addition to this legal requirement, the Afep-Medef Code recommends that listed companies with a low number of employees publish this information based on a scope that is more representative of their overall payroll or workforce in France. The Afep-Medef Code states that 80% of a company’s workforce in France can be considered as a representative scope.

Lagardère SCA has less than ten employees, not including the executive corporate officers who are employed by Lagardère Management.

Consequently, the tables below set out the required disclosures concerning (i) the scope corresponding to Lagardère SCA, in compliance with the compulsory provisions of Government Order, 2019-1234 of 27 November 2019, which have been applied on a voluntary basis, and (ii) the scope corresponding to all of the French companies exclusively controlled by Lagardère SCA within the meaning of article L. 233-16, II of the French Commercial Code, in accordance with recommendation 26.2 of the Afep-Medef Code.

The tables below show the remuneration paid or allocated during each year from 2016 to 2020 (i.e., including variable remuneration allocated in respect of the preceding year).

The remuneration amounts presented include – for the executive corporate officers as well as employees – the fixed portions, variable portions, and extraordinary remuneration paid during the year stated, on a gross basis.

In accordance with Afep-Medef guidelines, they also include free shares awarded during the year, valued in accordance with IFRS. The value stated corresponds to their grant-date valuation and therefore does not actually represent the value of the shares that will effectively be delivered at the end of the vesting period, which will depend on (i) the Company’s share price on the delivery date and (ii) the achievement rate of the applicable performance conditions. For the Company’s free share plans awarded in 2016, 2017 and 2018, the average delivery rate of shares to executive corporate officers was 31%. In addition, the value of the shares at their delivery date still does not reflect an amount paid to executive corporate officers since the shares cannot in any case be sold before the end of a minimum period of two years, and one-half of the shares remains subject to further holding periods.

The amounts shown below do not, however, include the valuation of benefits-in-kind or, for employees, the components of employee savings plans (statutory and discretionary profit-shares, etc.), as details of these components cannot be provided for all of the employees included in the French scope.

Finally, the performance criteria presented are the financial criteria applied for calculating the executive corporate officers’ annual variable remuneration for fiscal years 2015 to 2020:

- the growth rate for recurring operating profit of fully consolidated companies, determined based on the rules defined in the Group’s market guidance; and

- net cash from operating activities of fully consolidated companies, which represents the cash generated by the Group’s operations.

As the remuneration amounts shown for each year are the amounts actually paid, these performance indicators are given each time for year Y-1, i.e., the year in respect of which they were assessed for the purpose of calculating the executive corporate officers’ variable remuneration for year Y.

Arnaud Lagardère

| 2016 | 2017 | 2018 | 2019 | 2020 | |

| Remuneration paid or allocated during the year (in €) | 2,851,822 | 2,851,822 | 2,445,529 | 2,768,929 | 2,672,455 |

| Average remuneration paid or allocated during the year to Company employees (in €) | 444,525 | 415,095 | 328,974 | 352,018 | 277,431 |

| Ratio versus the average remuneration of Company employees | 6 | 7 | 7 | 8 | 10 |

| Median remuneration paid or allocated during the year to Company employees (in €) | 269,460 | 255,548 | 251,902 | 260,472 | 212,681 |

| Ratio versus the median remuneration of Company employees | 11 | 11 | 10 | 11 | 13 |

| Average remuneration paid or allocated during the year to Group employees in France (in €) | 55,032 | 57,659 | 56,468 | 56,098 | 52,338 |

| Ratio versus the average remuneration of Group employees in France | 52 | 49 | 43 | 49 | 51 |

| Median remuneration paid or allocated during the year to Group employees in France* (in €) | 50,985 | 51,771 | 50,535 | 50,745 | 50,675 |

| Ratio versus the median remuneration of Group employees in France* | 56 | 55 | 48 | 55 | 53 |

| Year-on-year increase in Group recurring operating profit (in %) | +8.84 | +13.5 | +6.74 | +2.14 | +5.63 |

| Net cash from operating activities of fully consolidated companies in the prior year (in €m) | 523.7 | 457.9 | 318.2 | 482.5 | 513.6 |

(*) The median remuneration of Group employees in France and the corresponding ratio do not include the value of free shares as this component cannot be disclosed meaningfully for this extremely wide scope. No free shares were awarded in 2020.

Pierre Leroy

| 2016 | 2017 | 2018 | 2019 | 2020 | |

| Remuneration paid or allocated during the year (in €) | 2,837,485* | 2,959,280* | 2,702,440* | 2,722,380* | 2,123,367 |

| Average remuneration paid or allocated during the year to Company employees (in €) | 444,525 | 415,095 | 328,974 | 352,018 | 277,431 |

| Ratio versus the average remuneration of Company employees | 6 | 7 | 8 | 8 | 8 |

| Median remuneration paid or allocated during the year to Company employees (in €) | 269,460 | 255,548 | 251,902 | 260,472 | 212,681 |

| Ratio versus the median remuneration of Company employees | 11 | 12 | 11 | 10 | 10 |

| Average remuneration paid or allocated during the year to Group employees in France (in €) | 55,032 | 57,659 | 56,468 | 56,098 | 52,338 |

| Ratio versus the average remuneration of Group employees in France | 52 | 51 | 48 | 49 | 41 |