2.4 Supervisory Board

2.4.1 MEMBERS

Pursuant to the Articles of Association, the Supervisory Board comprises a maximum of 12 members.

Around a quarter of Board members are replaced or re-appointed each year. Members are appointed for a maximum term of four years.

At 31 December 2019, the Board comprised 12 members.

Items appearing in the Annual Financial Report are cross‑referenced with the following symbol AFR

List of members of the Supervisory Board at 28 February 2020

| Personal information | Experience | Position on the Board | Participation in Board committees |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Age | Sex | Nationality | Number of shares |

Number of directorships held in listed companies(1) |

Independence(2) | First appointed | End of term of office |

Board seniority |

||

| Patrick Valroff Chairman |

71 | M | French | 600 | 1 | Yes | 27 April 2010 |

2022 OGM(*) |

9 years | Audit Committee (Chairman) Strategy Committee |

| Nathalie Andrieux | 54 | F | French | 600 | 2 | Yes | 3 May 2012 | 2020 OGM(*) |

7 years | |

| Jamal Benomar | 62 | M | British Moroccan |

150 | 0 | Yes | 12 September 2018 |

2023 OGM(*) |

1 year | Appointments, Remuneration and CSR Committee |

| Martine Chêne | 69 | F | French | 400 | 0 | Yes | 29 April 2008 |

2020 OGM(*) |

11 years | |

| François David | 78 | M | French | 600 | 1 | Yes | 29 April 2008 |

28 February 2020 |

11 years | |

| Yves Guillemot | 59 | M | French | 600 | 3 | Yes | 6 May 2014 | 2022 OGM(*) |

5 years | |

| Soumia Malinbaum | 57 | F | French | 650 | 1 | Yes | 3 May 2013 | 2021 OGM(*) |

6 years | Appointments, Remuneration and CSR Committee |

| Hélène Molinari | 56 | F | French | 600 | 1 | Yes | 3 May 2012 | 2020 OGM(*) |

7 years | |

| Guillaume Pepy | 61 | M | French | 600 | 1 | Yes | 27 February 2020(3) |

2020 OGM(*) |

0 years | Audit Committee Strategy Committee (Chairman) |

| Gilles Petit | 63 | M | French | 600 | 1 | Yes | 10 May 2019 |

2023 OGM(*) |

1 year | Strategy Committee Appointments, Remuneration and CSR Committee (Chairman) |

| Nicolas Sarkozy | 65 | M | French | 1 153 | 1 | Yes | 27 February 2020(3) |

2022 OGM(*) |

0 years | Strategy Committee |

| Xavier de Sarrau | 69 | M | Swiss | 750 | 1 | Yes | 10 March 2010 |

28 February 2020 |

9 years | |

| Aline Sylla‑Walbaum | 47 | F | French | 610 | 0 | Yes | 3 May 2013 | 2021 OGM(*) |

6 years | Audit Committee Appointments, Remuneration and CSR Committee |

| Susan M. Tolson | 57 | F | American | 600 | 3 | Yes | 10 May 2011 | 2023 OGM(*) |

8 years | Audit Committee |

| Laure Rivière Secretary |

Yes | |||||||||

(1) Outside the Lagardère group.

(2) Under the Afep-Medef corporate governance criteria applied by the Supervisory Board (see below).

(3) Co-optation effective 28 February 2020.

(*) The Ordinary General Meeting to be held in the year indicated to approve the financial statements for the previous year.

| PATRICK VALROFF Chairman of the Supervisory Board Chairman of the Audit Committee Member of the Strategy Committee |

||

| Nationality: French 4, rue de Presbourg, 75116 Paris, France Date of birth: 3 January 1949 |

Patrick Valroff holds a degree in law and is a graduate of the Institut d’Études Politiques de Paris and École Nationale d’Administration. He began his career in the French civil service. In 1991, he joined the specialist consumer credit company Sofinco as Deputy Chief Executive Officer. In 2003, he was appointed Head of Specialised Financial Services at Crédit Agricole SA Group, which comprises Sofinco, Finaref, Crédit Agricole Leasing and Eurofactor, and subsequently served as Chairman and Chief Executive Officer of Sofinco. From May 2008 to December 2010, Patrick Valroff was Chief Executive Officer of Crédit Agricole Corporate and Investment Bank. Patrick Valroff is an honorary magistrate at the French National Audit Office (Cour des Comptes). |

|

| Directorships and other positions held in other companies In France:

|

Directorships and other positions held during the last five years None. |

|

(1) Listed company.

| NATHALIE ANDRIEUX Member of the Supervisory Board |

||

| Nationality: French 171, rue de l’Université, 75007 Paris, France Date of birth: 27 July 1965 |

Nathalie Andrieux graduated from the École Supérieure d’Informatique (SUPINFO) in Paris in 1988. She began her career in banking with the Banques Populaires group, where she was involved in information systems development projects. In 1997, she joined the La Poste group as manager of the corporate information systems department. In late 2001, she became head of strategic marketing within the strategy division and, in 2003, was appointed head of La Poste’s innovation and e-services department. Based on her solid background in management, strategy, innovation and organisation, Nathalie Andrieux became Chief Executive Officer of Mediapost in 2004 and led its European expansion starting in 2008. Appointed Chair of Mediapost in 2009, Nathalie Andrieux was responsible for Mediapost’s 2010-2013 strategic plan and expanded its media services offering with the creation of Mediapost Publicité and the acquisitions of Sogec (a leader in promotional marketing), Mediaprism (a communications and customer knowledge agency), Adverline (an internet media operator), and Cabestan (a leading company in digital marketing platforms and customer relationship management solutions). She was appointed Chair of Mediapost Communication at the time of its creation in September 2011. In addition to holding this position, in September 2012, she was appointed Executive Vice President in charge of expanding the digital services of the La Poste group. On 18 January 2013, she became a member of the French Digital Council (Conseil national du numérique) and joined the Mines-Telecom Institute’s Scientific Advisory Board (Conseil Scientifique de l’Institut Mines-Télécom) in September 2013. In April 2014, under the “La Poste 2020: Conquering the Future” strategic plan, Nathalie Andrieux became the head of the Group’s new Digital Division. In November 2014, she became a member of the Supervisory Board of XAnge Private Equity. She left the La Poste group in March 2015. In April 2018, she was appointed Chief Executive Officer of Geolid. |

|

| Mandats et fonctions exercés dans d’autres sociétés In France :

|

Directorships and other positions held during the last five years

|

|

(1) Société cotée.

| JAMAL BENOMAR Member of the Supervisory Board Member of the Appointments, Remuneration and CSR Committee |

||

| Nationality: British and Moroccan 9, Rutland Road Scarsdale, NY 10583, United States Date of birth: 11 April 1957 |

Jamal Benomar has 35 years of experience in roles with international responsibility, including as Special Advisor to the UN Secretary-General and as Under-Secretary-General. After earning degrees in sociology, economics and politics from the universities of Rabat, Paris and London, Jamal Benomar worked as a lecturer and research associate. At the UN, his work focused on diplomatic actions and governance issues. |

|

| Directorships and other positions held in other companies None. |

Directorships and other positions held during the last five years None. |

|

| MARTINE CHÊNE Member of the Supervisory Board |

||

| Nationality: French 64, rue du Parc, 34980 Saint-Gély-du-Fesc, France Date of birth: 12 May 1950 |

Martine Chêne joined the Lagardère group in 1984, and worked as an archivist at Hachette Filipacchi Associés (HFA) until March 2009. She was the secretary of HFA’s Works Committee, a CFDT union representative and an employee representative. She represented the CFDT union on the Group Employees’ Committee. |

|

| Directorships and other positions held in other companies None. |

Directorships and other positions held during the last five years None. |

|

| FRANÇOIS DAVID Member of the Supervisory Board until 28 February 2020 |

||

| Nationality: French 6, rue Auguste-Bartholdi, 75015 Paris, France Date of birth: 5 December 1941 |

François David is a graduate of the Institut d’Études politiques de Paris and École nationale d’administration, and holds a degree in sociology. He began his career at the French Finance Ministry in 1969 as an administrative officer with a range of duties in the Foreign Trade Mission. In 1986, he was appointed Chief of Staff at the Foreign Trade Ministry. He became Head of Foreign Trade Relations at the French Ministry of Finance and Economics in 1987, and was the General Director of International Affairs at Aerospatiale from 1990 to 1994. François David was Chairman of the Board of Directors of Coface from 1994 to 2012, before becoming Senior Advisor to Moelis & Company. |

|

| Directorships and other positions held in other companies In France :

|

Directorships and other positions held during the last five years

|

|

(1) Listed company.

| YVES GUILLEMOT Member of the Supervisory Board |

||

| Nationality: French 28, rue Armand-Carrel, 93100 Montreuil, France Date of birth: 21 July 1960 |

Yves Guillemot is a graduate of the Institut de Petites et Moyennes Entreprises. He co-founded Ubisoft along with his four brothers in 1986, before becoming Chairman. Ubisoft expanded rapidly in France, as well as on the main international markets. Yves Guillemot, now Chairman and Chief Executive Officer of the company, led Ubisoft to become one of the world’s biggest video game publishers. Ubisoft employs more than 17,000 talented people in some 40 studios worldwide, who create and sell video games published by Ubisoft and its partners across five continents. In 2018, Yves Guillemot was named “Entrepreneur of the Year” by audit firm Ernst & Young. He also won the “Franco-Québécois Company Manager of the Year Award” in France in 2012, the “Personality Award” at the European Games Awards in Germany in 2011 and the “Grand Prix” at the MCV Awards in the UK in 2011. |

|

| Directorships and other positions held in other companies In France :

Outside France:

Yves Guillemot also holds the following positions within the Ubisoft, Guillemot Corporation and Guillemot Brothers groups, both in France and abroad:

Outside France:

|

Directorships and other positions held during the last five years In France :

|

|

(1) Listed company.

| SOUMIA MALINBAUM Member of the Supervisory Board Member of the Appointments, Remuneration and CSR Committee |

||

| Nationality: French 17, rue de Phalsbourg, 75017 Paris, France Date of birth: 8 April 1962 |

Soumia Belaidi Malinbaum has spent most of her career working in the digital and technologies sector, both as a founder and managing director of small and medium-sized companies. She is currently Deputy Chief Executive Officer of Keyrus, a management consulting firm which was merged with Specimen, the IT company she created and managed for 15 years. Before being appointed Business Development Manager of the group, she was Director of Human Resources. She is extremely committed to promoting and managing diversity in the corporate environment and is President of the European Association of Diversity Managers and founder of the French equivalent (AFMD). | |

|

Directorships and other positions held in other companies

|

Directorships and other positions held during the last five years

|

|

| HÉLÈNE MOLINARI Member of the Supervisory Board |

||

| Nationality: French 19 bis, rue des Poissonniers, 92200 Neuilly-sur-Seine, France Date of birth: 1 March 1963 |

Hélène Molinari is a graduate engineer. She began her career in 1985 as a consultant at Cap Gemini and in 1987 joined the Robeco group where she was responsible for developing institutional sales. In 1991, she joined the Axa group where she was involved in creating Axa Asset Managers, a leading asset management company. In 2000, she was appointed Head of Marketing and e-Business at Axa Investment Managers and in 2004 became a member of the Management Committee as Global Head of Brand and Communication. In 2005, she joined Medef where she occupied a number of positions reporting to Laurence Parisot, notably as head of communications, membership and social activities. She also supervised a number of support functions including the Corporate Secretary’s department, and contributed to the drafting of the Afep-Medef Corporate Governance Code. In 2011, she was appointed Chief Operating Officer and member of the Executive Council of Medef. In 2013, she joined Be-Bound as a Vice President. Be-Bound is a digital startup that is based in France and in Silicon Valley, which allows users to stay connected to the Internet even with no data access. In 2014, she became executive corporate officer of AHM Conseil, a company specialising in the organisation of cultural events, and in 2015, co-founded the contemporary art fair, Asia Now. | |

| Directorships and other positions held in other companies In France :

|

Directorships and other positions held during the last five years

|

|

(1)Listed company.

| GUILLAUME PEPY Member of the Supervisory Board Chairman of the Strategy Committee Member of the Audit Committee |

||

| Nationality: French 2, rue des Falaises Beaurivage, 64200 Biarritz Date of birth: 26 May 1958 |

A graduate of Institut d’études politiques de Paris and École nationale d’administration, Guillaume Pepy began his career as an auditor before becoming a legal assistant at the Conseil d’État, France’s highest administrative court. Having pursued a career at ministerial office level (Technical Advisor to the Chief of Staff of the Budget department, Chief of Staff to the Minister for Civil Service and Administrative Reform, then Chief of Staff to the Minister for Labour, Employment and Vocational Training), he became Deputy Chief Executive Officer in charge of business development at the Sofres group in 1996. The following year, he took the helm at SNCF’s Mainline Services unit, later becoming head of all passenger business. He created Voyages-sncf.com and served as its chairman from 1998 to 2006, before being appointed Group Chief Operating Officer by Louis Gallois in 2003. On 27 February 2008, he was appointed by Nicolas Sarkozy as Chairman of SNCF for a five-year term, and was re-appointed by François Hollande in 2013. In his second term, Guillaume Pepy’s primary mission was to continue leading France’s major rail reform and pave the way for the creation of the new SNCF rail group on 1 January 2020. | |

| Directorships and other positions held in other companies In France :

|

Directorships and other positions held during the last five years

|

|

(1) Listed company.

| GILLES PETIT Member of the Supervisory Board Member of the Strategy Committee Chairman of the Appointments, Remuneration and CSR Committee |

||

| Nationality: French 67, rue de Versailles, 92410 Ville-d’Avray, France Date of birth: 22 March 1956 |

Gilles Petit is a well-known figure in the French distribution landscape. Having begun his career in 1980 with Arthur Andersen, he joined the Promodès group in 1989, where at the time of the merger with Carrefour in 1999, he held the position of Chief Executive Officer of the hypermarkets division for Promodès in France. He was successively appointed managing director of Carrefour Belgium in 2000, of Carrefour Spain in 2005, and of Carrefour France in 2008, until in 2010 he joined Elior as Chief Executive Officer and Chairman of the Executive Committee, taking charge of its stock market listing on Euronext Paris in 2014. He was appointed Chief Executive Officer of Maisons du Monde in 2015, and also successfully led the stock market listing of that company. Gilles Petit is a graduate of the École supérieure de commerce de Reims, in France. | |

| Directorships and other positions held in other companies In France :

Outside France

|

Directorships and other positions held during the last five years

|

|

(1) Listed company.

| NICOLAS SARKOZY Member of the Supervisory Board Member of the Strategy Committee |

||

| Nationality: French 77, rue de Miromesnil, 75008, Paris, France Date of birth: 28 January 1955 |

Nicolas Sarkozy is the 6th President of France’s Fifth Republic (2007-2012). Mayor of Neuilly-sur-Seine (1983-2002), National Assembly Representative for Hauts-de-Seine (1988‑2002), President of the General Council for Hauts-de-Seine (2004-2007), Minister for the Budget (1993-1995), Minister for Communications (1994-1995), Government spokesman (1993-1995), Minister of the Interior, Internal Security and Local Freedoms (2002-2004), Minister of State, Minister for the Economy, Finance and Industry (2004), Minister of State, Minister of the Interior and Town and Country Planning (2005-2007). He was also the elected leader of French political parties UMP (2004-2007) and Les Républicains (2014-2016). A trained lawyer, Nicolas Sarkozy is married and has four children. He is the author of several books, including Libre, Témoignage, La France pour la vie, Tout pour la France and Passions. | |

| Directorships and other positions held in other companies In France :

|

Directorships and other positions held during the last five years

|

|

| XAVIER DE SARRAU Member of the Supervisory Board until 28 February 2020 |

||

| Nationality: Swiss 4, rue de Presbourg, 75116 Paris, France Date of birth: 11 December 1950 |

Xavier de Sarrau is a graduate of the HEC business school and holds a doctorate in tax law. He is a lawyer registered with the Bars of Paris and Geneva and specialises in issues concerning the governance and organisational structure of family-owned companies and private holdings. Xavier de Sarrau worked with the Arthur Andersen Group from 1978 to 2002, serving as Managing Partner for France, Managing Partner for EMEIA, and Managing Partner for Worldwide Global Management Services, and was also a member of the firm’s World Executive Committee. After setting up his own law firm outside France, in 2005 Xavier de Sarrau was one of the founders of the Paris law firm Sarrau Thomas Couderc. In 2008, he left Sarrau Thomas Couderc (which was subsequently renamed STC Partners) and since that date he has not held any interests in the firm. | |

| Directorships and other positions held in other companies In France :

|

Directorships and other positions held during the last five years

|

|

(1) Listed company.

| ALINE SYLLA-WALBAUM Member of the Supervisory Board Member of the Audit Committee Member of the Appointments, Remuneration and CSR Committee |

||

| Nationality: French 7, rue Mirabeau, 75016 Paris, France Date of birth: 12 June 1972 |

A graduate of HEC business school, Institut d’Etudes Politiques de Paris and École Nationale d’Administration, Aline Sylla-Walbaum is an Inspector of Finance and was appointed International Managing Director (Luxury) of Christie’s in September 2014. Before joining Christie’s in 2012 as Managing Director of Christie’s France, the world’s leading art business, she was Deputy Chief Executive Officer of Development at Unibail-Rodamco, Europe’s leading listed commercial property company, cultural and communications advisor to the office of the French Prime Minister from 2007 to 2008, and Deputy Executive Director, Director of Cultural Development at the Louvre museum for five years. | |

| Directorships and other positions held in other companies None. |

Directorships and other positions held during the last five years

|

|

| SUSAN TOLSON Member of the Supervisory Board Member of the Audit Committee |

||

| Nationality: American 2344, Massachusetts Ave NW, Washington DC 20008, United States Date of birth: 7 March 1962 |

Susan M. Tolson graduated from Smith College in 1984 with a B.A. cum laude before obtaining an MBA from Harvard in 1988. She joined Prudential Bache Securities as a corporate finance analyst in 1984 and subsequently took on the position of Investment Officer in Private Placements at Aetna Investment Management in 1988. In 1990, she joined The Capital Group Companies – a major private US investment fund formed in 1931 – where between April 1990 and June 2010 she successively served as a financial analyst, senior account manager and then Senior Vice-President, a position she left to join her husband in Paris. Over the last 20 years, Susan M. Tolson has issued recommendations and made decisions relating to investments in numerous business sectors, including the media and entertainment industries. | |

| Directorships and other positions held in other companies In France :

|

Directorships and other positions held during the last five years

|

|

(1) Listed company.

Changes in the composition of the Supervisory Board and the Supervisory Boar Committees in 2019 and up to 28 February 2020

At 28 February 2020

| Departures | Appointments | Re-appointments | |

|---|---|---|---|

| Supervisory Board | Georges Chodron de Courcel (10 May 2019) François Roussely (10 May 2019) Xavier de Sarrau (resigned as Chairman of the Supervisory Board on 4 December 2019) François David (28 February 2020) Xavier de Sarrau (28 February 2020) |

Gilles Petit (10 May 2019) Patrick Valroff (appointed Chairman of the Supervisory Board on 4 December 2019) Guillaume Pepy (co-opted on 27 February 2020 with effect from 28 February 2020) Nicolas Sarkozy (co-opted on 27 February 2020 with effect from 28 February 2020) |

Jamal Benomar (10 May 2019) Susan Tolson (10 May 2019) |

| Audit Committee | Xavier de Sarrau (resigned as Chairman of the Committee on 4 December 2019) Nathalie Andrieux (28 February 2020) François David (28 February 2020) Xavier de Sarrau (28 February 2020) |

Patrick Valroff (appointed Chairman of the Committee on 4 December 2019) Guillaume Pepy (28 February 2020) Susan Tolson (28 February 2020 |

|

| Appointments, Remuneration and CSR Committee | Georges Chodron de Courcel (10 May 2019) François David (28 February 2020) Hélène Molinari (28 February 2020) |

Gilles Petit (12 June 2019) Gilles Petit (appointed Chairman of the Committee on 28 February 2020) Jamal Benomar (28 February 2020) Aline Sylla-Walbaum (28 February 2020) |

|

| Strategy Committee | Guillaume Pépy (appointed Chairman of the Committee on 27 February 2020) Gilles Petit (27 February 2020) Nicolas Sarkozy (27 February 2020) Patrick Valroff (27 February 2020) |

Besides the changes recommended to the Annual General Meeting of 5 May 2020, no significant changes are planned to date in the composition of the Supervisory Board.

The Supervisory Board pays particular attention to its composition and to the composition of its Committees.

The Board has put in place a policy aimed at ensuring Board and Board Committee members have a broad range of skills (managerial, financial, strategic and/or legal), experience and knowledge of the Group’s businesses, as well as different age, gender, nationality and cultural profiles. This diversity is essential to the effectiveness of the Board’s work, guaranteeing high quality discussions and the proper performance of its supervisory duties.

In order to put this policy into place, the Board adopted a series of criteria for selecting members that mirror these goals, based on a recommendation of the Appointments, Remuneration and CSR Committee. The composition of the Supervisory Board and the Board Committees is reviewed each year by the Appointments, Remuneration and CSR Committee, which reports its findings to the Supervisory Board and puts forward recommendations in this regard. Each year, the Board critically reviews its composition through the self-assessment procedure.

In this way, members form a competent, independent and attentive Supervisory Board, fully able to represent shareholders’ interests (see below).

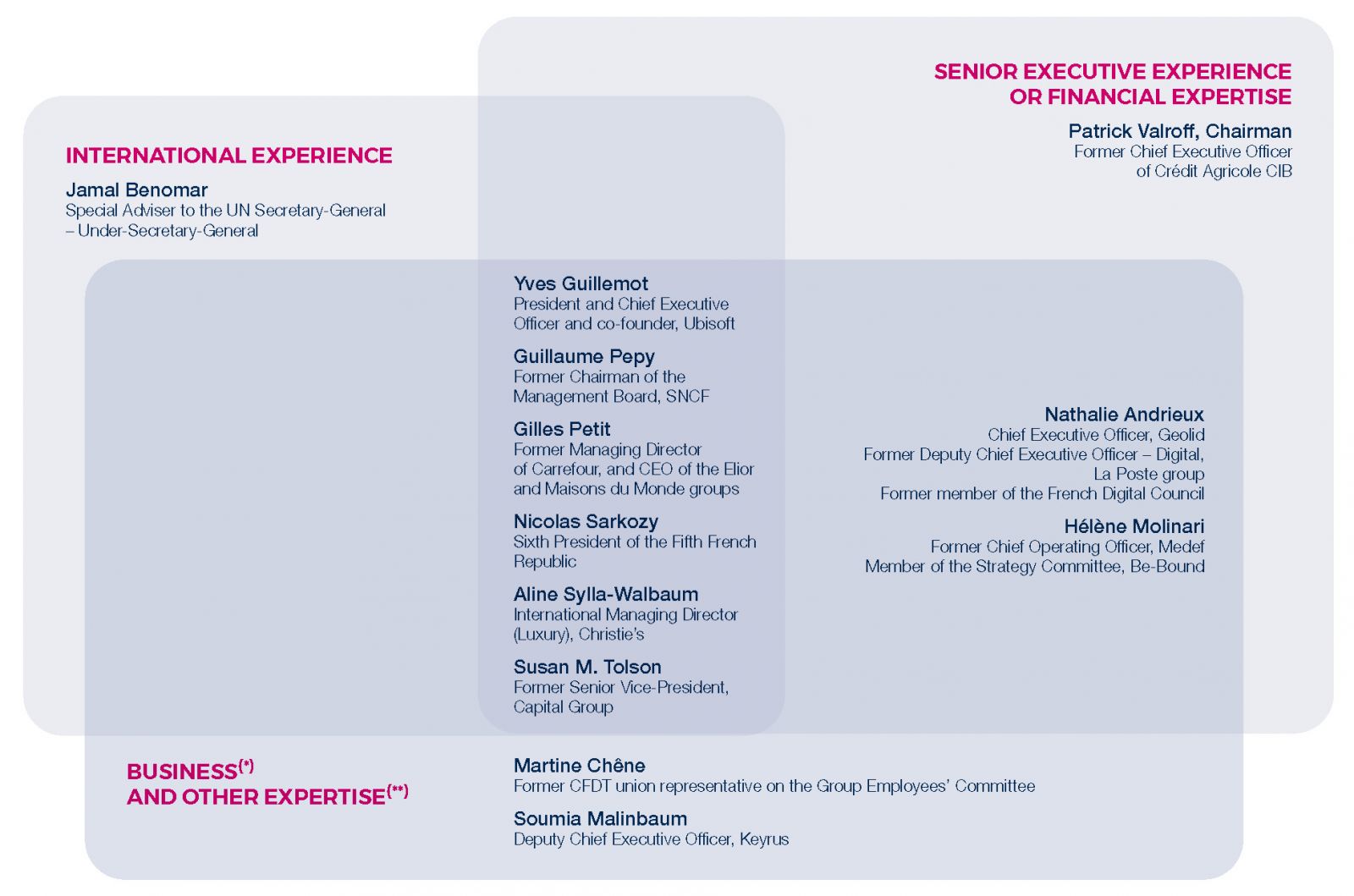

The chart below reflects the results of the policy in place:

- Yves Guillemot, Guillaume Pepy, Gilles Petit, Nicolas Sarkozy, Aline Sylla-Walbaum, Susan M. Tolson provide business and other expertise, international experience as well as senior executive experience or financial expertise.

- Jamal Benomar provides international experience.

- Patrick Valroff provides senior executive experience or financial expertise

- Martine Chêne and Soumia Malinbaum provide business and other expertise.

- Nathalie Andrieux and Hélène Molinari provide senior executive experience or financial expertise as well as business and other expertise.

(*) Media/Distribution/Innovation/New technologies/Travel Retail.

(**)Legal/Governance/Social relations/Diversity.

Moreover, in application of the provisions of the Pacte law, a resolution will be put to the vote at the Annual General Meeting of 5 May 2020 asking the shareholders to amend the Company’s Articles of Association in order to set out the terms and conditions for appointing employee representative members of the Supervisory Board.

In view of its supervisory duties, the Board must have a majority of independent members.

At its meeting of 25 February 2020, the Appointments, Remuneration and CSR Committee therefore reviewed the situation of each of the Supervisory Board members and of Guillaume Pepy and Nicolas Sarkozy, whose appointments were recommended to the Supervisory Board on 27 February 2020.

In particular, the Committee considered that the volume of business assigned to the Realyze law firm and the attendant fees paid to that firm are not material to the Group or to Realyze (it being specified that Nicolas Sarkozy himself does not provide any legal advisory services to the Group), and that accordingly, Nicolas Sarkozy qualifies as an independent member.

Based on this review, it was concluded that all members qualify as independent members in the light of the criteria for independence, applied by the Supervisory Board and contained in the Afep-Medef Corporate Governance Code, which it has taken as a benchmark framework for analysis (see table below).

Summary table of Supervisory Board members’ compliance with the independence criteria set out in the Afep-Medef Corporate Governance Code at 28 February 2020

| P. Valroff | N. Andrieux | J. Benomar | M. Chêne | F. David | Y. Guillemot | S. Malinbaum | H. Molinari | G. Pepy | G. Petit | N. Sarkozy | X. de Sarrau | A. Sylla-Walbaum | S. Tolson | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Independence criteria set out in the Afep-Medef Corporate Governance Code and applied by the Supervisory Board | ||||||||||||||

| Not to be an unprotected employee or executive corporate officer of the Company or its parent company or a company that it consolidates, and not to have been in such a position for the previous five years | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Not to be an executive corporate officer of a company in which the Company holds a directorship, directly or indirectly, or in which an employee appointed as such or an executive corporate officer of the Company (currently in office or having held such office for less than five years) is a director or member of the Supervisory Board | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Not to be, directly or indirectly, related to a customer, supplier, investment or commercial banker:

|

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Not to be related by close family ties to a Managing Partner | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Not to have been an auditor of the Company within the previous five years |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Not to hold, directly or indirectly, 10% or more of the share capital or voting rights of the Company or of the Group or be related in any way whatsoever to a shareholder with an investment greater than 10% of the Company or a Group company | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Not to receive variable remuneration in cash or shares or any other remuneration linked to the performance of the Company or Group | ✓ | N/A | ||||||||||||

| Conclusion | Independant | Independant | Independant | Independant | Independant | Independant | Independant | Independant | Independant | Independant | Independant | Independant | Independant | Independant |

| P. Valroff | N. Andrieux | J. Benomar | M. Chêne | F. David | Y. Guillemot | S. Malinbaum | H. Molinari | G. Pepy | G. Petit | N. Sarkozy | X. de Sarrau | A. Sylla-Walbaum | S. Tolson | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Independence criteria set out in the Afep-Medef Corporate Governance Code and not applied by the Supervisory Board | ||||||||||||||

| Not to have been a member of the Supervisory Board for more than 12 years | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

2.4.2 BOARD’S INTERNAL RULES AND OPERATION

The terms and conditions of the Supervisory Board’s organisation and operations are set out in its internal rules, which also define the duties incumbent on each member and the code of professional ethics each individual member is bound to respect. These internal rules are updated regularly, most recently on 28 February 2020.

These rules concern the following:

- The independence of Board members: the minimum quota for independent members is fixed at half of the total serving members. Independent members must have no direct or indirect relations of any kind with the Company, the Group or its Management that could compromise their freedom of judgement or participation in the work of the Board. It lists a number of criteria, which form a framework for determining whether or not a member may be considered independent;

- The annual number of meetings: a schedule for the coming year is fixed annually, based on a proposal by the Chairman;

- The duties of each member: apart from the fundamental duties of loyalty, confidentiality and diligence, members’ obligations also concern knowledge of the law, regulations and statutory provisions, ownership of a significant number of shares, declaration to the Board of any conflict of interest and regular attendance at meetings;

- Trading in shares of the Company and its subsidiaries: as Board members have access to inside information and in-depth knowledge on certain aspects of the life of the Company and Group, they are expected to refrain from trading in Company shares, except within the following restrictions contained in the Board’s internal rules:

- no trading in shares may take place during certain defined periods,

- it is recommended that acquisitions should take place once a year, at the end of the Annual General Meeting, in the form of a block purchase carried out through the Company by each Board member,

- the Secretary General of Lagardère SCA and the French financial markets authority (Autorité des marchés financiers – AMF) must be informed of any transactions in shares within three days of their completion;

- The existence of an Audit Committee: in addition to the tasks described below, this Committee is also responsible for preparing the Board meetings for subjects within its remit;

- The existence of an Appointments, Remuneration and CSR Committee (formerly the Appointments, Remunerations and Governance Committee): in addition to the tasks described below, this Committee is also responsible for preparing the Board meetings for subjects within its remit;

- The existence of a Strategy Committee: this Committee was set up by the Supervisory Board on 27 February 2020. Its role and responsibilities are described below.

In addition, in accordance with the new provisions introduced by the Pacte law in France, the Supervisory Board approved an Internal Charter on the procedure for identifying related-party agreements subject to the monitoring procedure set out in the French Commercial Code. Any agreements considered susceptible to meeting the definition of a related-party agreement are submitted prior to signature to the Secretary General, who determines their classification in light of the criteria set out in the charter. Agreements are regularly reviewed, particularly in the event they are amended, renewed or terminated, to ensure that the specified criteria continue to be met.

2.4.3 2019 WORK SCHEDULE

The Supervisory Board meets regularly to review the financial position and operations of the Company and its subsidiaries, the annual and interim financial statements, the outlook for each of the business activities taking into account corporate social responsibility issues, and the Group’s strategy. During these meetings, the Committees report to the Board on their work. The Supervisory Board defines an annual schedule for its meetings, four of which are planned for 2020. During 2019, the Supervisory Board met four times:

- On 13 March with a 100% attendance rate, mainly to review the parent company and consolidated financial statements and the general business position and outlook, undertake preparatory work for the Annual General Meeting, approve the report on corporate governance and adopt its report to the shareholders. At the same meeting, the Supervisory Board recommended the re-appointment of certain members whose terms of office were set to expire at the Annual General Meeting, and it reviewed the agreement signed and authorised during a previous year that remains in effect. Lastly, it approved the terms and conditions for awarding free shares to Lagardère SCA’s executive corporate officers and amended the internal rules of the Supervisory Board.

- On 12 June, with a 92% attendance rate, to review recent developments within the Group, in particular the situation at Europe 1 and Lagardère News (presentation given by Constance Benqué, Marie Renoir-Couteau and Donat Vidal Revel), and to hear the findings of the research about managing millennials in the Group, carried out by two Supervisory Board members. The Board also discussed the course of action to take following a letter received from a minority shareholder.

- On 11 September, with a 100% attendance rate, to once again review recent developments within the Group and to examine the interim parent company and consolidated financial statements. The Board also discussed the progress of Lagardère Travel Retail’s acquisition of International Duty Free (presentation given by Dag Rasmussen and his team) and approved its work plan for 2020.

- On 4 December, with a 100% attendance rate, to appoint a new Chairman of the Supervisory Board and a new Chairman of the Audit Committee, review the recent developments within the Group and examine the planned reorganisation of the Corporate functions.

Also during the year a working group was created, made up of Supervisory Board members, to review the Group’s succession planning.

In June 2019, the Supervisory Board convened for a seminar during which its members held in-depth discussions on the Group’s strategy, as well as on the business activities and outlook of Lagardère Publishing and Lagardère Travel Retail.

Lastly, in addition to his traditional duties, the Chairman of the Supervisory Board also performs other specific services in view of his professional experience. The Group considers it beneficial not only to draw on his opinions on matters within the traditional remit of the Supervisory Board, but also to engage in a regular dialogue that affords him a better understanding of the key events and developments impacting the Group, so that he can in turn share that insight with the other members of the Board. As such, he may be consulted by General Management on certain key or strategic events for the Group. The Chairman of the Supervisory Board must also ensure the appropriate balance between advising, taking part in the process for appointing and renewing the Board, and ensuring that any comments expressed by members of the Board, especially in meetings in which the Managing Partners are not present, are dealt with adequately. In 2019, these duties gave rise to numerous meetings with the Managing Partners, Secretary General, Chief Financial Officer, division senior executives and Statutory Auditors, as well as to working sessions with the Internal Audit and Risk departments. The Chairman of the Supervisory Board is responsible for any dealings between shareholders and the Board.

Members’ attendance at Supervisory Board and Committee meetings in 2019

| Member of the Board | Attendance rate at Supervisory Board meetings |

Attendance rate at Audit Committee meetings |

Attendance rate at Appointments, Remuneration and CSR Committee meetings |

|---|---|---|---|

| Nathalie Andrieux | 100 % | 100 % | - |

| Jamal Benomar | 100 % | - | - |

| Martine Chêne | 100 % | - | - |

| Georges Chodron de Courcel | 100 % | - | 100 % |

| François David | 100 % | 100 % | 100 % |

| Yves Guillemot | 75 % | - | - |

| Soumia Malinbaum | 100 % | - | 100 % |

| Hélène Molinari | 100 % | - | 100 % |

| Gilles Petit | 100 % | - | 100 % |

| François Roussely | 100 % | - | - |

| Xavier de Sarrau | 100 % | 100 % | - |

| Aline Sylla-Walbaum | 100 % | 100 % | - |

| Susan M. Tolson | 100 % | - | - |

| Patrick Valroff | 100 % | 100 % | - |

2.4.4 SUPERVISORY BOARD COMMITTEES

A) AUDIT COMMITTEE

| Members | Since 28 February 2020

|

Up to 28 February 2020

|

|---|---|---|

| Audit Committee members are appointed for their financial and/or accounting skills, assessed with particular regard to their past career (positions held in general or financial management or in an audit firm), academic background or specific knowledge of the Company’s business. The expert knowledge of the members of the Audit Committee is described in section 2.4.1 of the Universal Registration Document. At 28 February 2020, all the Audit Committee’s members were independent (see table above). | ||

| Main tasks | The Committee applies all of the recommendations contained in the AMF working group’s report of 22 July 2010, with the exception of those that it does not deem relevant with regard in particular to the tasks specific to a Supervisory Board of a French partnership limited by shares (société en commandite par actions – SCA), and thereby:

|

|

| Main activities in 2019 | During 2019, the Audit Committee met five times with an attendance rate of 100%, it being specified that two meetings to review the annual and interim financial statements were held more than five days before the Supervisory Board’s meetings.

|

|

B) STRATEGY COMMITTEE (CREATED ON 27 FEBRUARY 2020)

| Members |

|

|---|---|

| At 28 February 2020, all the Strategy Committee’s members were independent (see table above). | |

| Main tasks | The Strategy Committee is responsible for assisting the Supervisory Board in preparing and supporting its work regarding the ex-post supervision of business operations. In this respect, it receives all necessary information from the Managing Partners on:

|

C) APPOINTMENTS, REMUNERATION AND CSR COMMITTEE (FORMERLY THE APPOINTMENTS, REMUNERATION AND GOVERNANCE COMMITTEE)

| Members | Since 28 February 2020

|

Up to 28 February 2020

|

|---|---|---|

| At 28 February 2020, all of the Appointments, Remuneration and CSR Committee’s members were independent (see table above). | ||

| Main tasks |

The Chairman of the Committee reports to the members of the Board on the work conducted by the Committee. |

|

| Main activities in 2019 | In 2019, the Committee met five times with a 100% attendance rate at each meeting.

|

|

2.4.5 ASSESSMENT OF THE SUPERVISORY BOARD’S MEMBERSHIP STRUCTURE AND OPERATING PROCEDURES

Since 2009, the Supervisory Board has carried out an annual assessment of the operating procedures of the Board and its Committees in order to form an opinion on the preparation and quality of their work. Every three years, this assessment is performed by an independent consulting firm. In this context, the Supervisory Board commissioned an independent consulting firm in 2019 to carry out an external assessment, overseen by the Appointments, Remuneration and CSR Committee. The findings were presented to the Supervisory Board on 4 December 2019 and 27 February 2020.

The assessment mainly concerned the Board’s membership, as well as its operation, the organisation of its meetings, access to information, the agenda and work, the amount and distribution of attendance fees, and relations between the Board and the Managing Partners. It also involved a similar review of the Committees. Members also assessed their own individual contributions.

The members of the Supervisory Board voted unanimously to maintain the current modus operandi and not to require them to complete a formal questionnaire specifically designed to systematically assess the contribution of their fellow members. The members were mostly very satisfied with the membership, organisation and operation of the Board and its Committees. There was an improvement in the Board’s operation and performance and attendance at meetings was very satisfactory. The Board’s seminar, the topics and analyses presented, as well as the participants involved proved especially popular. The main areas that the Board members felt could be improved were (i) setting up a Strategy Committee, (ii) creating new working groups and (ii) receiving more information before meetings. There was a recommendation that certain senior executives could be asked more often by the Committees to participate and have input in meetings, in line with the items on the agenda.

2.4.6 COMPLIANCE WITH FRENCH CORPORATE GOVERNANCE REGULATIONS – AFEP-MEDEF

The Company has applied the corporate governance principles brought together in the Afep-Medef Corporate Governance Code (Code de gouvernement d’entreprise des sociétés cotées) revised in January 2020. This code is available in the Corporate Governance section of Lagardère’s website.

As stated in the introduction to the Code, most of the recommendations it contains have been established with reference to joint-stock companies with a board of directors. Companies with an executive board and supervisory board, and partnerships limited by shares, need to make adjustments as appropriate to implement the recommendations. By its very principle, a partnership limited by shares has a strict separation of powers between the Managing Partners who run the company (and thereby the General Partners who have unlimited liability), and the Supervisory Board, which reviews management actions ex-post but does not actively participate in management.

Given Lagardère SCA’s specificities in terms of French law and its own Articles of Association as a partnership limited by shares, the Board has adopted an organisational structure appropriate to the nature of its work under the law and the recommendations of the Afep-Medef Corporate Governance Code.

| Provision of the Afep-Medef Corporate Governance Code set aside or partially applied | Explanation |

|---|---|

| Independence criteria | |

| “Not to have been a director of the corporation for more than 12 years” | It is deemed that the fact of having been a Board member for more than 12 years does not disqualify such member as an independent member. On the contrary, it is considered an asset in a control role within a diverse group where it inevitably takes longer to build up in-depth knowledge of the different business lines and their competitive environment and to develop a strong command of the related strategic challenges. Moreover, the members of the Supervisory Board consider a long period of service to be a positive factor that does not alter an independent member’s judgement, moral standards or ability to freely express their views. However, no Supervisory Board member has been on the Board for more than 12 years. |