5.1 Per share data, dividend policy and share performance

5.1.1 PER SHARE DATA

| 2019 (4) | 2018 (2)(4) | 2017 (1) | ||||

|---|---|---|---|---|---|---|

| (in euros) | basic | diluted(3) | basic | diluted(3) | basic | diluted(3) |

| Profit (loss) attributable to owners of the Parent, per share | (0,12) | (0,12) | 1,36 | 1,34 | 1,36 | 1,34 |

| Equity attributable to owners of the Parent, per share | 11,73 | 11,58 | 13,21 | 13,04 | 13,76 | 13,56 |

| Cash flow from operations before change in working capital, per share(4) | 3,82 | 3,77 | 3,39 | 3,34 | 4,13 | 4,07 |

| Share price at 31 December | 19,43 | 22,02 | 26,73 | |||

| Dividend | 1,00 (5) | 1,30 | 1,30 | |||

| Extra dividend | - | - | - | |||

(1) Data for 2017 restated for the retrospective application of IFRS 15.

(2) Data for 2018 restated for the full retrospective application of IFRS 16 (see note 1.1 to the consolidated financial statements).

(3) The method used to calculate diluted earnings per share is described in note 15 to the consolidated financial statements.

(4) Lagardère Sports was classified as a discontinued operation in 2019 in accordance with IFRS 5. Its earnings and cash flows for 2019 and 2018 were respectively classified in profit (loss) from discontinued operations and net cash from (used in) discontinued operations (see note 4.3 to the consolidated financial statements).

(5) Dividend submitted for approval to the General Meeting to be held on 5 May 2020.

5.1.2 DIVIDEND POLICY

Total dividends paid for the years 2016, 2017 and 2018 amounted to €170.0 million, €168.8 million and €169.7 million, respectively. The dividend payouts represented 96.0% and 96.1% of profit attributable to owners of the Parent in 2017 and 2018.

Items appearing in the Annual Financial Report are cross‑referenced with the following symbol AFR

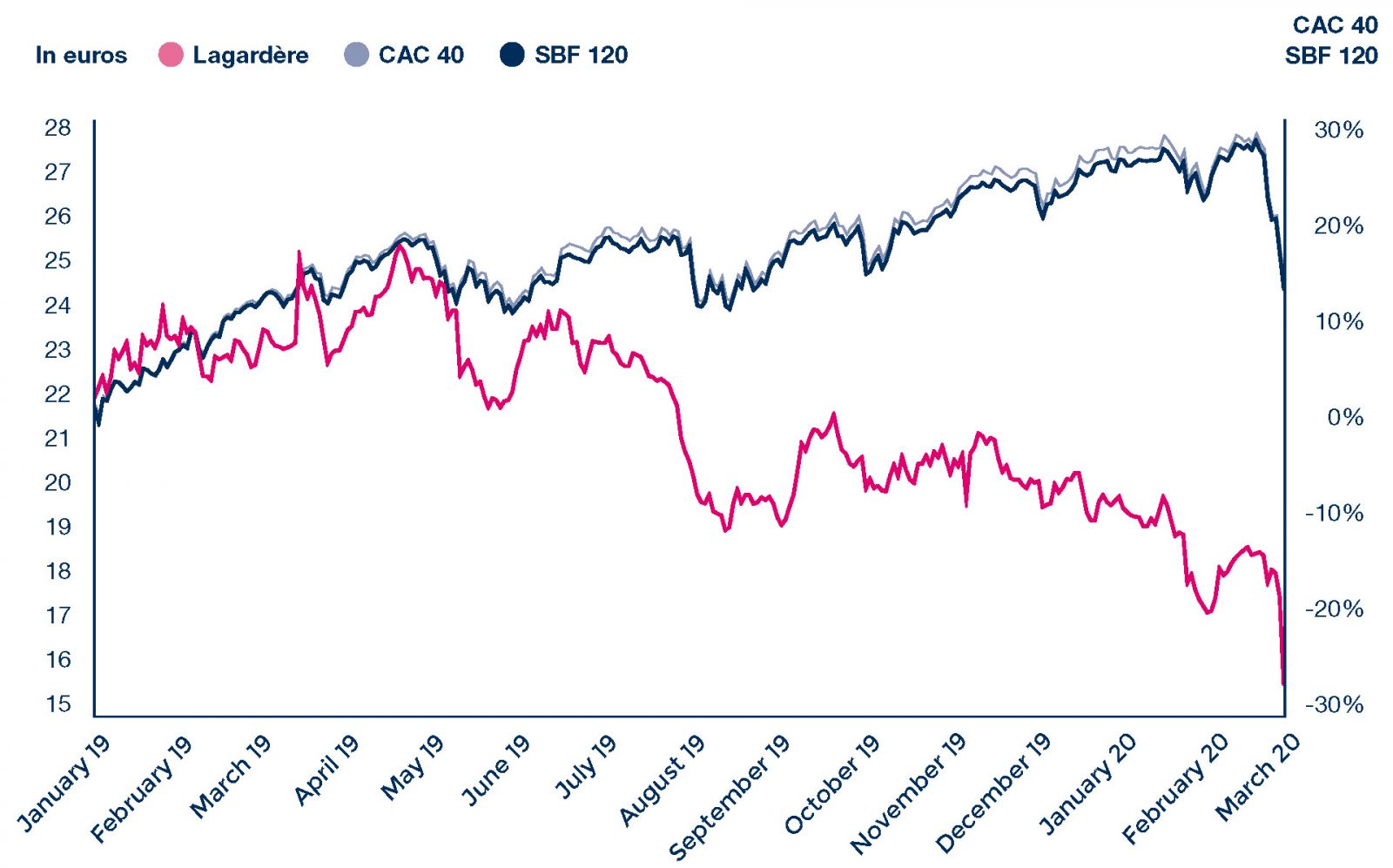

5.1.3 SHARE PERFORMANCE SINCE JANUARY 2019

Lagardère’s share performance in comparison with the SBF 120 and CAC 40 indexes between January 2019 and March 2020.

Source: Euronext Paris.